Credit Union Marketing: Adapting Your Marketing Strategy for a Mobile-First Generation

As younger consumers increasingly rely on smartphones for everything from social interactions to financial management, credit unions must evolve their approach to remain competitive and attract new members.

The statistics paint a clear picture of our mobile-centric world. According to Statista, 96% of internet users access the web via mobile devices. This shift towards mobile isn’t just about access; it’s about lifestyle. The average American spends 4 hours and 37 minutes looking at their phone daily, checking it an astonishing 144 times. These numbers underscore a fundamental truth: to reach potential members, credit unions must meet them where they are – on their mobile devices.

For credit unions, this mobile-first landscape presents both challenges and opportunities. Traditional marketing methods are no longer sufficient to capture the attention of younger generations who expect seamless, on-the-go digital experiences. Credit unions must reimagine their marketing strategies to align with the habits and preferences of these mobile-savvy consumers.

This shift requires more than just having a mobile-friendly website or app. It demands a comprehensive approach to integrating mobile considerations into marketing and member engagement. From social media campaigns and personalized push notifications to mobile-optimized content and location-based promotions, credit unions have a wealth of tools to connect with the mobile-first generation.

Understanding the Mobile-First Generation

As credit unions adapt their marketing strategies, it’s crucial to understand the characteristics and preferences of the mobile-first generation. These younger consumers, primarily Millennials and Gen Z, have grown up with smartphones integral to their daily lives, shaping their expectations for financial services.

Our research reveals a significant generational divide in banking preferences. While Boomers and Gen Xers are more likely to use only online banking, Gen Zers show a slight preference for exclusive mobile banking. This shift highlights the importance of tailoring your credit union’s digital offerings to meet the evolving needs of younger members.

Mobile-First Marketing Tactics for Credit Unions

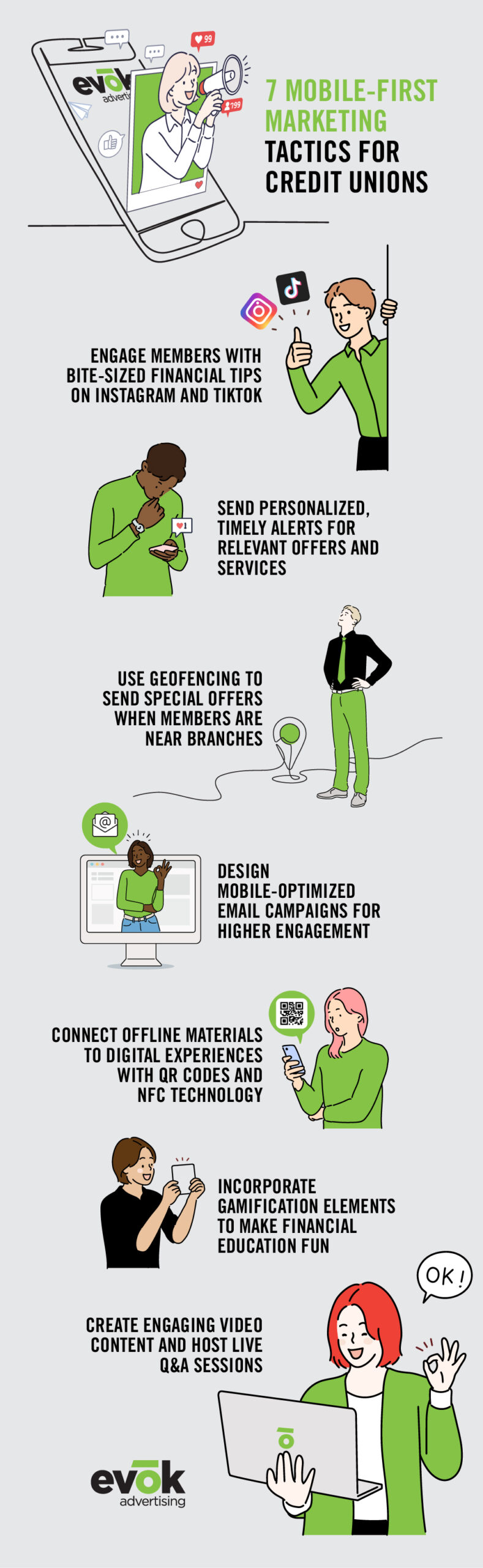

As credit unions adapt to the mobile-first generation, implementing targeted marketing tactics is crucial. Here are some strategies to effectively reach and engage younger members:

Social Media Engagement

With 79% of U.S. adults active on social channels, platforms like Instagram, TikTok, and Facebook offer immense potential for credit unions to build awareness and brand preference. However, success on these platforms requires more than a presence – it demands strategic, value-driven content.

Create engaging, bite-sized financial tips using Instagram Reels or TikToks. Use YouTube for in-depth explainer videos and customer testimonials. Today’s users expect informative, entertaining, and easily digestible content.

Personalized Push Notifications

Leverage your mobile app to send targeted, relevant notifications to members. For example, alert a member about a new low-rate auto loan offer when they’re nearing the end of their current car lease. The key is to provide value, not spam – use data analytics to ensure timely and personalized notifications.

Location-Based Marketing

Take advantage of geofencing technology to send special offers when members are near your physical branches. This tactic bridges the digital and physical worlds, encouraging app users to engage with your credit union in person.

Mobile-Optimized Email Campaigns

While email might seem old school, it remains a powerful tool when optimized for mobile. Design your emails with mobile screens in mind, using responsive templates and concise, actionable content. Follow up on website interactions with targeted email nurturing campaigns, like mortgage seminar invites or rate alerts.

QR Codes and NFC Technology

Integrate QR codes into your physical marketing materials and NFC (Near Field Communication) technology into your credit and debit cards. These tools can seamlessly connect offline experiences to your mobile app, enhancing member engagement.

Leverage Chatbot Marketing

The majority of people who engage with businesses via their mobile devices prefer to reach out to businesses via messages on their platform of choice. Messages offer a casual environment users are already used to using, and it’s a powerful tool to engage with potential customers. Ensuring you business has a chatbot implemented on social media and your website allows users to find the information they need in an interactive and engaging manner. With proper implementation and a campaign strategy behind it, it could even help you increase business revenue!

Gamification and Financial Education

Incorporate game-like elements into your mobile app to make financial education more engaging. For instance, create challenges or quizzes that reward members for saving money or improving their financial literacy.

Video Content and Live Streaming

Embrace video content for product explanations, financial advice, and community updates. Consider hosting live Q&A sessions on platforms like TikTok Live or Instagram Live to engage with members and directly answer their questions in real-time.

Influencer Partnerships

Collaborate with local influencers or community leaders who resonate with your target demographic. Their authentic endorsement can help build trust and credibility among younger audiences.

Omni-Channel Digital Marketing: Meeting Members Where They Are

In 2024, successful credit union marketing isn’t about choosing a single channel—it’s about seamlessly integrating multiple platforms to create a cohesive member experience. While this approach requires expertise and resources, the potential payoff is substantial.

Consider this: 70% of financial searches happen on mobile devices. Credit unions that expand their content and backlink profiles can significantly improve their visibility in local search results. Although SEO is a long-term strategy, the increased traffic it drives makes it a crucial component of any digital marketing plan.

But the journey doesn’t end at the website. Email nurturing campaigns can transform initial website interactions into meaningful conversations. For instance, following up with mortgage seminar invites or rate alerts can guide prospects further down the conversion funnel, turning curious visitors into committed members.

Managing these channels—from SEO to email marketing to social media—may seem daunting. However, credit unions that successfully leverage data analytics to optimize digital experiences across all touchpoints will be well-positioned for sustainable member growth in the years ahead.

The key is to view these efforts as separate initiatives and interconnected pieces of a larger puzzle. By creating a cohesive strategy that spans multiple channels, credit unions can provide the seamless, personalized experience that today’s mobile-first-generation demands.

Measuring Success in Mobile Marketing

In the fast-paced world of mobile-first marketing, tracking and analyzing your efforts is crucial to ensure you’re hitting the mark with younger generations. Credit unions should focus on a range of key performance indicators to gauge the success of their mobile initiatives. App engagement metrics, such as daily and monthly active users, session length, and feature usage, provide valuable insights into how members interact with your digital offerings. Monitoring mobile website performance, including traffic percentage, page load times, and conversion rates, is essential for crucial actions like loan applications.

Social media plays a significant role in reaching the mobile-first generation. Hence, tracking engagement rates on mobile-optimized content and click-through rates from social platforms to your website or app is essential. When optimized for mobile, email campaigns remain a powerful tool, making it vital to analyze mobile, open rates, and conversions driven by these efforts. Ultimately, the success of your mobile strategy should be reflected in overall acquisition and retention metrics, such as new member sign-ups through mobile channels and the lifetime value of mobile-first members.

To gather this data, utilize analytics tools built into your mobile app and website. A/B testing is crucial for mobile optimization – experiment with different layouts, content formats, and call-to-action placements to see what resonates best with your mobile audience. Remember, the goal isn’t just to accumulate data but to derive actionable insights. Review these metrics to identify trends, adjust your strategy, and continually improve your mobile marketing efforts.

Marketing Challenges in a Mobile-First World

As credit unions pivot towards mobile-first marketing, they encounter several unique challenges that require innovative solutions. One of the primary hurdles is cutting through the digital noise. In a world where the average American checks their phone 144 times daily, capturing and maintaining attention becomes increasingly tricky. Credit unions must find ways to make their mobile marketing messages stand out amidst notifications, emails, and social media updates.

Another significant challenge lies in creating content that resonates with the mobile-first generation while still appealing to older members. Striking this balance requires a deep understanding of diverse demographic preferences and behaviors. For instance, while Gen Z might prefer short-form video content on platforms like TikTok or Instagram Reels, older members might engage more with longer-form content or traditional email campaigns.

Personalization at scale presents another hurdle. While data analytics offer unprecedented opportunities for tailored marketing, implementing genuinely personalized experiences across a large membership base can be complex and resource-intensive. Credit unions must find ways to leverage member data effectively without entering invasive territory.

Embracing the Mobile Future: Your Credit Union’s Path Forward

As explored throughout this blog post, adapting your credit union’s marketing strategy for a mobile-first generation is not just a trend—it’s necessary for sustainable growth and relevance in today’s digital landscape. With 96% of internet users accessing the web via mobile devices and the average American spending over 4 hours daily on their smartphones, the message is clear: meet your members where they are or risk being left behind.

Becoming a mobile-first credit union involves more than having a responsive website or a functional app. It requires a fundamental shift in how you approach member engagement, from personalized experiences and omni-channel marketing to addressing the unique challenges of mobile security and content creation.

Remember, the mobile-first approach doesn’t mean mobile-only. Your strategy should seamlessly integrate with other channels to create a cohesive member experience. This integrated approach allows you to cater to the preferences of younger, tech-savvy members while still serving the needs of your entire membership base.

As you move forward, keep these key points in mind:

- Personalization is paramount. Leverage data analytics to provide tailored experiences that resonate with individual members.

- Content is king, but context is queen. Ensure your marketing messages are mobile-friendly and mobile-optimized for various platforms and user behaviors.

- Stay agile and innovative. The mobile landscape is constantly evolving, and so should your marketing strategies.

- Measure, analyze, and adapt. Regularly assess the performance of your mobile marketing efforts and be prepared to pivot when necessary.

The shift to mobile-first marketing may seem daunting, but it also presents exciting opportunities for credit unions to showcase their unique value proposition. Combining the personal touch and community focus that credit unions are known for with cutting-edge mobile technologies can create a powerful marketing strategy that drives member acquisition, engagement, and loyalty.

The future of credit union marketing is mobile, personal, and dynamic. Are you ready to lead the way? Get in touch with our team to explore how custom omnichannel campaigns can help your credit union master these key trends and drive sustainable member acquisition and retention results in 2024 and beyond.