Restaurant Marketing Trends: Food Service Loyalty In The US For 2022

After months of inconsistent and uncertain restaurant visitation, the foodservice industry continues to battle the labor crisis, supply chain issues and the impact of inflation, all of which compromise restaurants’ ability to meet consumers’ expanded needs for high-quality offerings and service at competitive prices. In order to survive, it is non-negotiable for foodservice operators to focus on establishing and maintaining consumer loyalty. Most restaurants are approaching the endeavor by launching loyalty programs and rewarding their loyal customers in innovative ways.

A Look at the Foodservice Industry in 2022

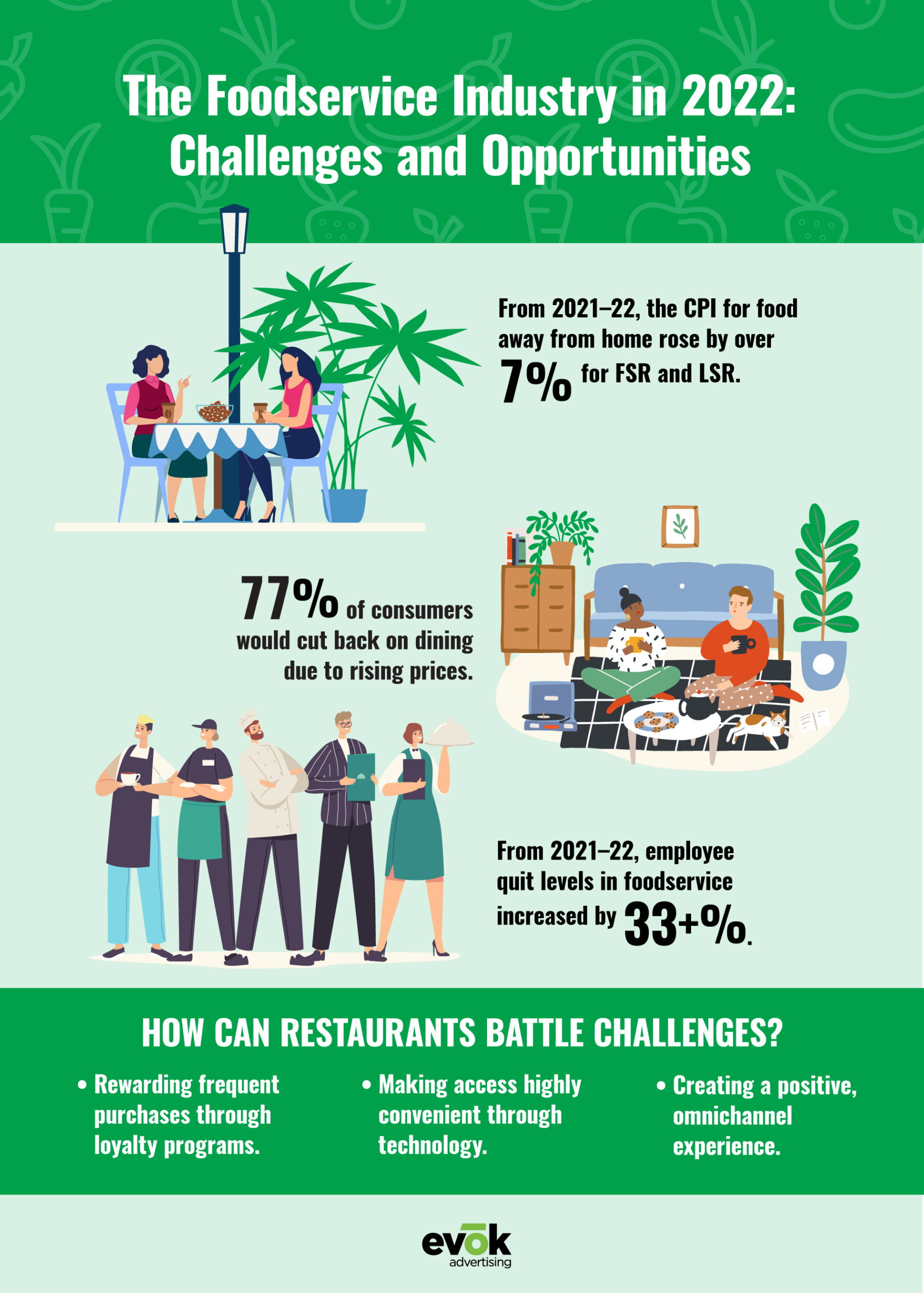

The foodservice industry continues to face labor challenges and battle supply chain issues that have worsened due to the conflict in Ukraine. Decades-high inflation adds another significant headwind to the industry’s recovery, negatively impacting both restaurant profit margins and consumer discretionary spending on dining out. From 2021-22, the CPI for food away from home rose by over 7% for both FSR and LSR segments, while food at home increased by 10%. This economic climate makes it difficult for smaller industry players to invest in restaurant technology and compete on par with the rest of the industry. Higher food costs both at home and away from home will also discourage consumers from dining out frequently at a time when most restaurants need consistent visitation to stay in business. However, dining out may be a more affordable and convenient option for many consumers given the high cost of groceries.

Even though consumers were enthusiastic about dining out more often in 2022, high price increases in food both at home and away from home have deterred them from doing so. Dining out emerged as the top discretionary category that consumers will cut back spending on in light of inflation. Consumers will trade down to lower-priced LSRs, limit dining out to fewer and more special occasions, or cook at home entirely. Restaurants already operating on thin profit margins will not be able to offer many deals and discounts, further losing business from more price-sensitive consumers.

From February 2021-22, employee quit levels in the accommodation and foodservices sector increased by over 33% and continue to rise. While many foodservice operators took steps to compete for talent in late 2021 by offering higher wages, expanded benefits and more flexibility, their efforts are falling short against decades-high inflation. Higher costs have added yet another layer of uncertainty for operators that are already dealing with inconsistent visitation, thus reducing the opportunities for workers to make tips and increasing the chances of layoffs. Other industries are also experiencing a labor crisis so leisure and hospitality workers are finding more stable and better paying opportunities elsewhere. On the consumer front, these issues compromise restaurants’ ability to deliver high-quality dining experiences – something consumers are hungry for after months of little access to dining opportunities.

All About Loyalty Programs

In addition to offering consumers a way to save money while still indulging in dining out, loyalty and subscription programs offer foodservice operators a way to study purchase patterns and establish personal connections with their customers that will go a long way in retaining consumer loyalty.

Most consumers find loyalty programs easy to use and expect to access them digitally via restaurant mobile apps and websites. However, in a time when consumers are already seeing necessary but rapid technological changes in the foodservice industry (eg robot cooks, digital kiosks, tablets), digital-exclusive loyalty programs can add to consumer fears around data privacy and further discourage tech-averse consumers from participating in loyalty programs, regardless of the moneysaving benefits they provide. About half of consumers consider ongoing discounts to be better than loyalty program rewards, suggesting that loyalty programs that require little to no effort from consumers and help them passively earn rewards or discounts will succeed. Operators will need to ensure that their loyalty and subscription programs are easy to access and use and can reward consumers placing orders in person or over the phone.

Loyalty programs are quickly becoming ubiquitous in the foodservice industry, particularly in the LSR segment. In most cases, loyalty programs award consumers points per dollar spent that can be redeemed for discounts or other perks on future orders. Most consumers find such monetary rewards to be the primary motivators to join loyalty programs. However, restaurants can gain competitive advantage by using loyalty apps and websites to deliver more personalized experiences to consumers that: draw on their order history and patterns, offer rewards that are relevant to their needs, and lend them flexibility and control in how they redeem their rewards.

Loyalty programs have the potential to provide restaurants with valuable consumer data and a set of frequent and loyal consumers. However, operators can also use loyalty programs to further strengthen their brands. Expanding laterally into new revenue streams by introducing restaurant-branded apparel, accessories, housewares and experiences can significantly raise brand awareness and aid in organic customer acquisition. Operators can also make use of social media platforms like Discord and Patreon to create online spaces for their most loyal customers to engage in as a community. Not only do consumers expect most restaurants to have loyalty programs, they are open to rewards that extend beyond discounts on future orders and are interested in merchandise rewards. Using loyalty and subscription programs to establish a personal connection with loyal customers will go a long way in making customers feel special.

Top Takeaways for Restaurant Operators in 2022

High-quality menu offerings are nonnegotiable

To establish consumer loyalty, there is no substitute for high-quality food and beverage offerings. Convenient location, competitive prices and high-quality service are some other loyalty motivators that operators can differentiate on. Most consumers have easy access to a variety of loyalty programs; restaurants that cannot meet the aforementioned non-negotiable requirements for loyalty will quickly lose customers to competition, especially considering how similar loyalty program offerings are in the foodservice market.

Consumers value flexibility and control in how they are rewarded for their loyalty

While most consumers prefer loyalty rewards that are monetary (ie ongoing discounts or credits toward future orders), there is also significant interest in programs that reward them with restaurant-branded merchandise or donations toward a cause. Such perks help foodservice brands establish a personal connection with their loyal customer base, who, in turn, can act as brand advocates, ultimately raising brand awareness and aiding new customer acquisition.

Adapting to changing consumer needs is crucial for retention

Operators must make use of the consumer data accessible to them through loyalty and subscription programs to deliver a highly personalized experience. Apart from studying purchase patterns of a restaurant’s customer base, operators can also leverage Millennials’ and Gen Zs’ overwhelming presence on social media. Engaging in social listening will help brands stay ahead of emerging tastes, preferences, and consumer responses to menu and operational changes in the foodservice industry