Building Brand Trust in the Digital Age: A Credit Union CMO’s Guide to Social Media Strategy

Trust has become one of the most valuable currencies for brands—especially in industries like financial services, where credibility and reliability are paramount. For credit unions, which thrive on member loyalty and community connections, maintaining a strong foundation of trust is essential to driving long-term growth and engagement. But how does a credit union stand out in today’s crowded digital landscape, where trust can be easily won or lost with a single social media post?

The answer lies in an effective, carefully crafted social media strategy. More than just a marketing tool, social media has evolved into a powerful platform where brands can build meaningful, authentic connections with their audiences. Credit unions can showcase their services, humanize their brand, communicate transparently, and cultivate trust at every touchpoint.

For credit union Chief Marketing Officers (CMOs), navigating the complexities of social media requires more than posting content—it requires a strategy rooted in trust-building. This blog will explore key strategies credit union CMOs can implement to build brand trust through social media.

Humanizing Your Brand Through Executive Engagement and Behind-the-Scenes Content

It’s no longer enough for credit unions to simply offer great products or services. Members want to connect with the people behind the brand and feel they understand who they’re doing business with. Credit unions have a unique opportunity to humanize their brands by leveraging executive engagement and behind-the-scenes content, creating stronger bonds with their audience.

Why It Matters: The Power of Personal Connections

Research shows that consumers value brands more when they can connect with the people behind them. According to data from Sprout Social, 70% of consumers feel more connected to a brand when the CEO maintains an active social presence. Moreover, nearly two-thirds (65%) of respondents say that when a CEO regularly uses social media, it gives the impression that real people run the business. These insights emphasize the importance of executive involvement in fostering a sense of authenticity and trust.

Similarly, showcasing your company’s culture—through employee spotlights, community involvement, and behind-the-scenes glimpses—can create emotional connections that logos and advertising simply can’t. People trust people, not corporate identities. Showing your credit union’s real faces and values makes your brand more relatable, trustworthy, and appealing to current and potential members.

Best Practices: How to Humanize Your Brand

1. Executive Engagement on Social Media: Making Leadership Visible

Credit unions’ involvement of top executives on social media offers a tremendous opportunity to demonstrate transparency and build trust. When your CEO or senior leaders are present online, sharing their vision, responding to customer feedback, or offering insights into the industry, it sends a clear message: this organization cares about its members and values open communication.

- Share Personal Insights: Encourage CEOs and other top executives to share company updates and personal reflections on the credit union’s goals, values, and vision for the future. The brand can post videos of the CEO speaking on Instagram and Facebook. On LinkedIn, the CEO can post professional thought leadership posts.

- Join Fun, Light-Hearted Trends: Executives can break the formality by participating in fun, trending challenges on platforms like Instagram or TikTok. Whether joining in a viral dance, sharing a throwback photo, or trying out a popular meme format, these moments show that your leadership team is approachable and relatable. It also gives members a glimpse into the more playful side of your CEO or executives, humanizing your brand and making the company culture more accessible.

2. Behind-the-Scenes Content: Bringing the Credit Union’s Culture to Life

Beyond executive involvement, another way to humanize your credit union is by showcasing the culture and the people who make the institution run smoothly daily. Behind-the-scenes content lets members glimpse your organization’s values, mission, and day-to-day operations. This type of content doesn’t have to be formal—the more relaxed and genuine it feels, the more relatable it becomes.

- Employee Spotlights: Highlight different team members across departments, from tellers to IT staff to loan officers. Share their stories, their roles in the credit union, and what motivates them to serve members. This boosts internal morale and helps members feel connected to the people working for their financial well-being.

- Showcase Community Involvement: Credit unions are often deeply involved in local communities. Showcase volunteer efforts, partnerships with local businesses, or charity events through platforms like Instagram, TikTok or Facebook Live. By sharing real moments of community service, you’re demonstrating your credit union’s commitment to positively impacting beyond just financial services.

- Highlight Company Values and Mission: Use social media to reiterate the credit union’s core values and mission. Share content that reflects those values, such as sustainability efforts, financial literacy initiatives, or support for local causes. By consistently showcasing your principles, you help members see your credit union’s actions align with its words.

Active Engagement: Responding to Comments and Feedback

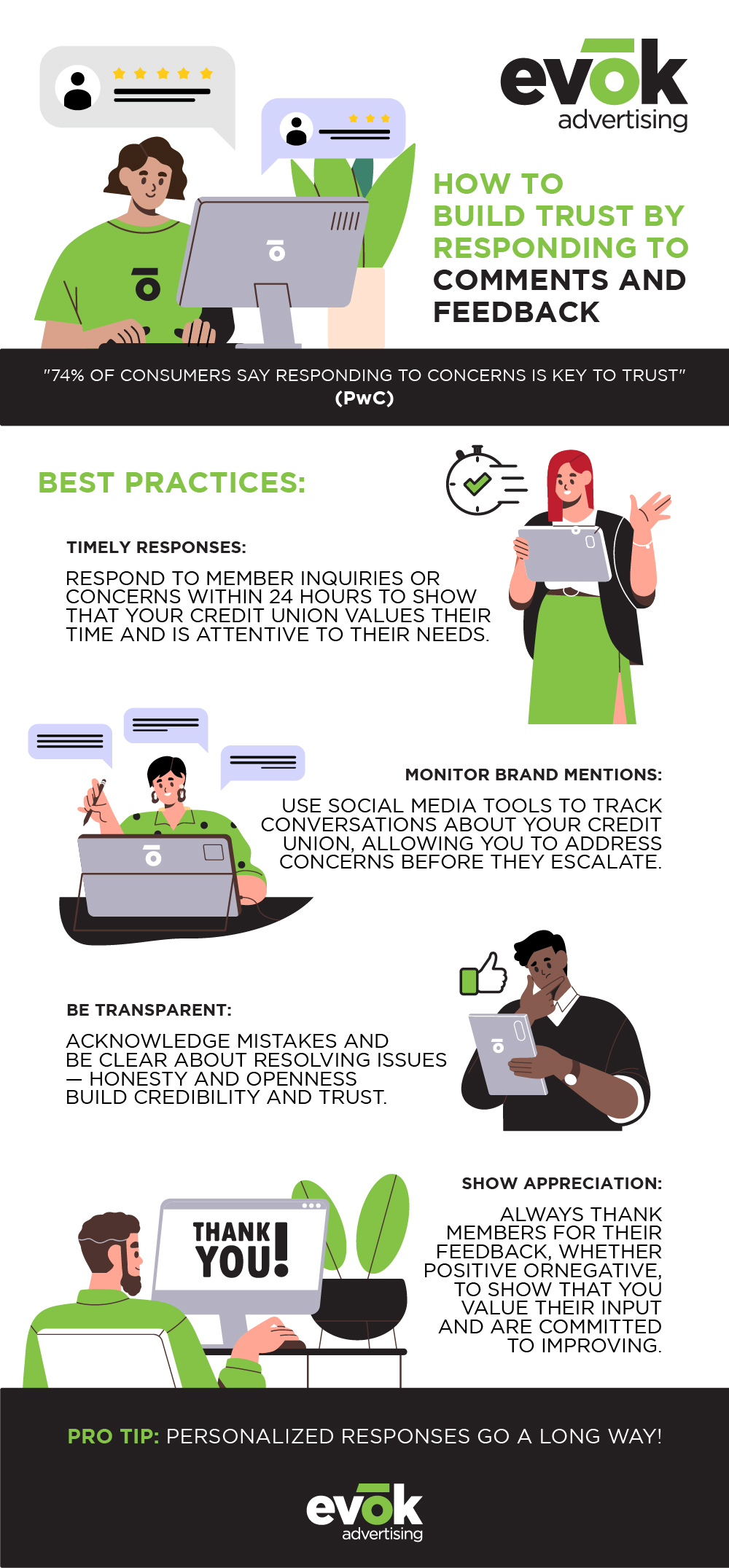

For credit unions, actively engaging with members through social media—particularly when responding to comments and feedback—is a critical component of building and maintaining trust. A PwC report underscores this point, revealing 74% of consumers say responding to and resolving concerns and delivering a consistent customer experience is essential to earning their trust. In short, how you respond to your members can either strengthen or damage your relationship with them.

Why It Matters: Trust is Built Through Dialogue

Conversations happen 24/7 on social media. Credit unions engage in these conversations—responding to questions, addressing concerns, and acknowledging feedback—and are seen as more approachable and trustworthy. Failing to engage, on the other hand, can give the impression your organization is indifferent to the concerns of its members.

When members voice concerns or ask questions online, they expect a timely and thoughtful response. A delayed or absent response can lead to frustration, erode trust, and ultimately damage your credit union’s reputation. However, when credit unions handle interactions with care—acknowledging member concerns, resolving issues promptly, and showing appreciation for feedback—it builds credibility and reassures members their voices are heard.

Furthermore, social media responses are not just about solving problems for the person who commented; they’re about showing the entire audience your credit union is proactive, transparent, and committed to delivering excellent service. Every public response is an opportunity to showcase your credit union’s values and foster a positive brand perception.

Best Practices: How to Respond Effectively

1. Timely Responses Are Key

Speed is crucial in today’s fast-paced world. When members reach out via social media—whether through a comment, direct message, or mention—they expect a quick response. A swift reply shows that your credit union values their time and is attentive to their needs.

- Set Expectations for Response Times: Many social platforms, such as Facebook, display response times on your profile, which can set expectations for members. Aim for a fast response rate, particularly for platforms like Facebook, X, and Instagram, where real-time interaction is expected. A quick response—ideally within 24 hours—demonstrates your commitment to member service.

- Create a Process for Monitoring Social Media: Use social media management tools like Sprout Social, Hootsuite, or Buffer to monitor mentions, comments, and direct messages. These tools allow you to track conversations about your credit union in real-time and ensure no comment goes unanswered.

2. Use Tools to Monitor and Address Concerns Before They Escalate

Social media can serve as an early warning system for potential issues, enabling your credit union to address concerns before they escalate. Whether a member posts a question about their account or voices a complaint about a service issue, these interactions offer valuable opportunities to step in and resolve the matter promptly.

- Monitor Brand Mentions Across Platforms: Not every comment will be posted directly to your social media pages. Members often mention your credit union in their posts or tag you in conversations elsewhere. Use monitoring tools to stay on top of these indirect mentions so you can step in and engage before an issue spirals into negative word-of-mouth.

- Escalate Issues Internally as Needed: Have a clear escalation process for more complex issues that can’t be resolved on social media. Direct members to appropriate customer service channels while ensuring the issue is still being addressed and tracked. Always follow up with the member to show their concern has been taken seriously.

3. Be Transparent and Show Appreciation for Feedback

Transparency is essential for building trust, and your responses on social media should reflect this. Whether addressing a simple question or handling a complaint, the key is to be open, honest, and appreciative.

- Address Concerns Transparently: When addressing member complaints or concerns, be honest about what happened and what steps your credit union is taking to resolve the issue. Acknowledge any mistakes and provide a clear resolution or next steps. Transparency demonstrates accountability, critical to building trust in the financial sector.

- Show Appreciation for Feedback: Whether feedback is positive or negative, showing gratitude for members taking the time to engage with your credit union is important. A simple “thank you” for a positive comment or a thoughtful acknowledgment of constructive criticism can go a long way. Members who feel appreciated are more likely to remain loyal and recommend your credit union to others.

- Personalize Your Responses: Avoid generic responses like, “Thank you for your comment.” Instead, personalize your messages to reflect the unique concerns or feedback of the member. Use their name, reference the specific issue, and offer a tailored solution or response. This attention to detail shows you value their input and are committed to meeting their needs.

Trust Building Through Influencer Marketing

Influencer marketing has become vital to the digital marketing landscape, especially regarding trust-building. For credit unions, collaborating with influencers may seem unconventional at first. However, influencers—particularly those with strong connections to local communities or niche financial audiences—can act as authentic voices who vouch for your brand. By leveraging influencers, credit unions can extend their reach, build credibility, and foster trust with new and existing members.

Influencer Authenticity and Relatability

Influencer marketing works because it’s built on trust. According to the 2024 Sprout Social Influencer Marketing Report, nearly half of all consumers trust influencers as much as they did six months ago, and close to 30% trust them even more. This growing trust is particularly strong among younger generations and frequent purchasers, who often turn to influencers for recommendations.

For credit unions, partnering with the right influencers—those who genuinely align with your values—can help establish a more personal and relatable brand image. Influencers have spent years building strong relationships with their audiences by being authentic, transparent, and engaging. When they promote a brand, their audience perceives it as an endorsement from a trusted friend, not a faceless corporation. This makes influencer marketing an incredibly effective tool for building brand trust in a way traditional advertising cannot achieve.

Best Practices: Using Influencers to Build Trust

1. Partner with Local Influencers or Micro-Influencers

While mega-influencers may have millions of followers, their relationship with their audience may not be as intimate or relatable. Instead, credit unions should focus on partnering with local influencers or micro-influencers with smaller but highly engaged followings. These influencers often have strong ties to local communities, making them ideal advocates for credit unions, which also emphasize community involvement.

- Find Influencers Who Align with Your Values: Look for influencers who genuinely share your credit union’s values, such as community service, financial literacy, or sustainability. When the partnership feels authentic, their endorsement of your credit union will be more credible.

- Focus on Niche Audiences: Partnering with influencers specializing in financial education, personal finance management, or community advocacy can help position your credit union as a trustworthy and valuable resource. These influencers often have dedicated audiences already interested in financial well-being, making their endorsement of your services more impactful.

2. Create Authentic Campaigns

Trust-building through influencer marketing hinges on authenticity. Audiences are savvy—they can easily tell when an influencer promotes a product or service solely for a paycheck. To build trust, credit unions should work with influencers to create campaigns that feel natural, honest, and valuable to their audience.

- Encourage Storytelling: Instead of a one-off post, encourage influencers to share personal stories about their experience with your credit union. Whether opening an account, applying for a loan, or engaging in community events, authentic storytelling resonates far better than a simple product mention.

- Highlight Community Involvement: Credit unions are known for their deep involvement in local communities, and this can be a powerful narrative for influencers to share. Partner with influencers to promote events or initiatives showing your credit union’s commitment to supporting local causes. This creates a sense of shared values between the influencer, your credit union, and their audience.

The Future of Brand Trust in the Digital Age

Credit unions, which rely heavily on member loyalty and community relationships, must prioritize trust-building at every opportunity. With its ability to foster real-time connections and create transparency, social media offers an unparalleled platform to strengthen those relationships.

The question is not whether to invest in these strategies but how to implement them effectively. That’s where we can help. Our team of credit union experts is ready to design a customized social media strategy that builds trust, drives engagement, and ultimately helps your credit union achieve its business goals. Let us help you turn these insights into action and set your brand up for lasting success in the digital age.

Ready to get started? Give us a call. Book time with our team to discuss how an effective Social Media Strategy plan can help your Credit Union build brand loyalty today.