Customer Retention vs. Customer Acquisition: Where Should Your Marketing Budget Go?

Marketers are constantly asked to do more with less. Less budget, less time, less margin for error. That pressure makes one question loom large: should we spend our limited resources acquiring new customers or keeping our existing ones engaged and loyal? On one hand, acquisition is flashy; it brings in fresh faces, fuels growth, and often gets the spotlight. On the other hand, retention is proven to be more cost-effective, more stable, and more profitable over time. For marketing teams focused on sustainable growth, the debate around customer retention vs. acquisition isn’t academic. It determines how marketing campaigns are structured and how success is measured over the long term. The real challenge isn’t choosing one over the other, but understanding when and how to prioritize each. In this blog, we’ll explore the cost differences between customer acquisition and retention, how to calculate their impact, and how your business stage, industry, and internal infrastructure can shape the smartest path forward.

Defining and calculating both acquisition and retention

Customer Acquisition

Customer acquisition refers to the process of attracting new individuals to your brand and converting them into paying customers. It’s the front-end of the customer journey, typically driven by awareness-building tactics such as digital advertising, search engine marketing, paid social media, influencer partnerships, content marketing, and events or sponsorships. These efforts are designed to introduce your product or service to new audiences and acquire new customers, ideally converting them into long-term relationships. The standard metric for measuring efficiency is customer acquisition cost, which helps evaluate how cost-effectively you’re growing your audience of existing customers and prospects.

The primary metric used to evaluate acquisition efficiency is customer acquisition cost, or CAC. This figure is calculated by dividing the total amount spent on acquisition-related marketing over a set period by the number of new customers acquired during that same period. For example, if a health system spends $20,000 in digital media promoting its primary care service line over one quarter, and sees 200 new patients book and attend a first appointment, the CAC would be $100. This number becomes a critical benchmark for financial planning, helping marketers understand how scalable and sustainable their growth strategies are. A lower CAC generally indicates a more efficient campaign, but it must also be considered in relation to customer lifetime value to paint the full profitability picture.

In healthcare specifically, acquisition plays a key role in building patient panels and expanding service line awareness. For a primary care practice, bringing in new patients may involve geo-targeted search ads, insurance-based targeting, or digital campaigns emphasizing convenience and availability. Each new patient acquired represents potential long-term revenue, not just from the initial visit, but from future appointments, referrals to specialists, and preventative care services. That’s why understanding CAC at the service line level is crucial—it informs how much budget is reasonable to spend to attract a new patient based on the downstream value they represent.

Customer Retention

Customer retention focuses on maintaining and nurturing the relationships you’ve already built. Rather than attracting new customers, retention strategies aim to keep existing ones satisfied, engaged, and returning. These efforts can take many forms, including email marketing, loyalty programs, appointment reminders, personalized offers, and reputation management. Each one is designed to support customer retention strategies that deepen the customer relationship and increase long-term value. The goal is to keep loyal customers engaged, satisfied, and more likely to refer others.

Retention can be measured in a variety of ways depending on your business model. Common metrics include customer retention rate (the percentage of customers who continue doing business with you over a specific period), churn rate (the inverse), repeat purchase or visit rate, and customer lifetime value. While marketers may not always think of retention as having a direct cost, the way acquisition does, investments still exist. Email platforms, CRM tools, loyalty software, and internal resources all factor into the cost of retaining customers. What makes retention particularly attractive is that these costs are typically lower and more consistent than acquisition efforts, and the return on investment tends to be higher, especially when customer satisfaction is strong.

In a healthcare setting, patient retention is a powerful driver of long-term revenue and health outcomes. For example, a primary care provider might use automated email reminders for annual physicals or send a personalized message after a visit to check in and encourage a follow-up. If a patient visits once per year for five years, the total revenue from that relationship may significantly exceed the initial cost to bring them in. Let’s say the average annual value of a primary care patient is $400, and the system retains the patient for five years; that’s $2,000 in lifetime value. If the retention efforts (email campaigns, staff time, CRM tools) cost $50 per patient per year, the retention cost would total $250, well below the long-term value generated.

Technology Stack Considerations

Executing an acquisition and retention strategy at scale requires the right tools. Marketers should evaluate:

- CRM systems to track and segment customers

- Customer data platforms (CDPs) to unify and activate data

- Marketing automation tools for email, SMS, and behavioral campaigns

- Experience platforms or loyalty engines to drive engagement and track lifecycle behavior

Without the infrastructure to support personalization, targeting, and measurement, even the best strategies fall flat.

Tactic Comparison: Restaurant vs. Primary Care

For restaurants, retention might include a loyalty app with push notifications, bounce-back coupons, birthday offers, and targeted local social ads.

In contrast, healthcare marketers promoting primary care services might deploy automated reminders for annual physicals, email follow-ups with care plan summaries, and satisfaction surveys tied to Net Promoter Scores. They may also build “care gap” campaigns using EHR and CRM data to ensure patients stay active and compliant.

These tactical layers reinforce the core strategy and make retention a daily discipline, not just a philosophy.

When in your business cycle should you focus more on acquisition and retention?

Your place in the business lifecycle plays a central role in determining whether customer acquisition or retention should take priority. In the early stages of growth, such as during startup or launch, it’s essential to focus on acquisition to generate awareness, build a customer base, and validate your offerings. During this phase, most marketing spend is allocated toward driving new traffic, leads, and first-time conversions. It’s a volume game, and the goal is to reach as many potential customers as possible.

As the business matures, retention becomes a smarter and more efficient use of your marketing budget. Once a solid foundation of customers has been built, marketing efforts should shift toward retaining customers rather than spending heavily on net-new acquisition. This shift ensures more predictable revenue and better operational efficiency while improving your bottom line. Mature businesses that over-prioritize acquisition often experience diminishing returns on ad spend, while those that invest in retention see more predictable revenue, lower churn, and greater long-term profitability.

Budget Allocation by Business Stage

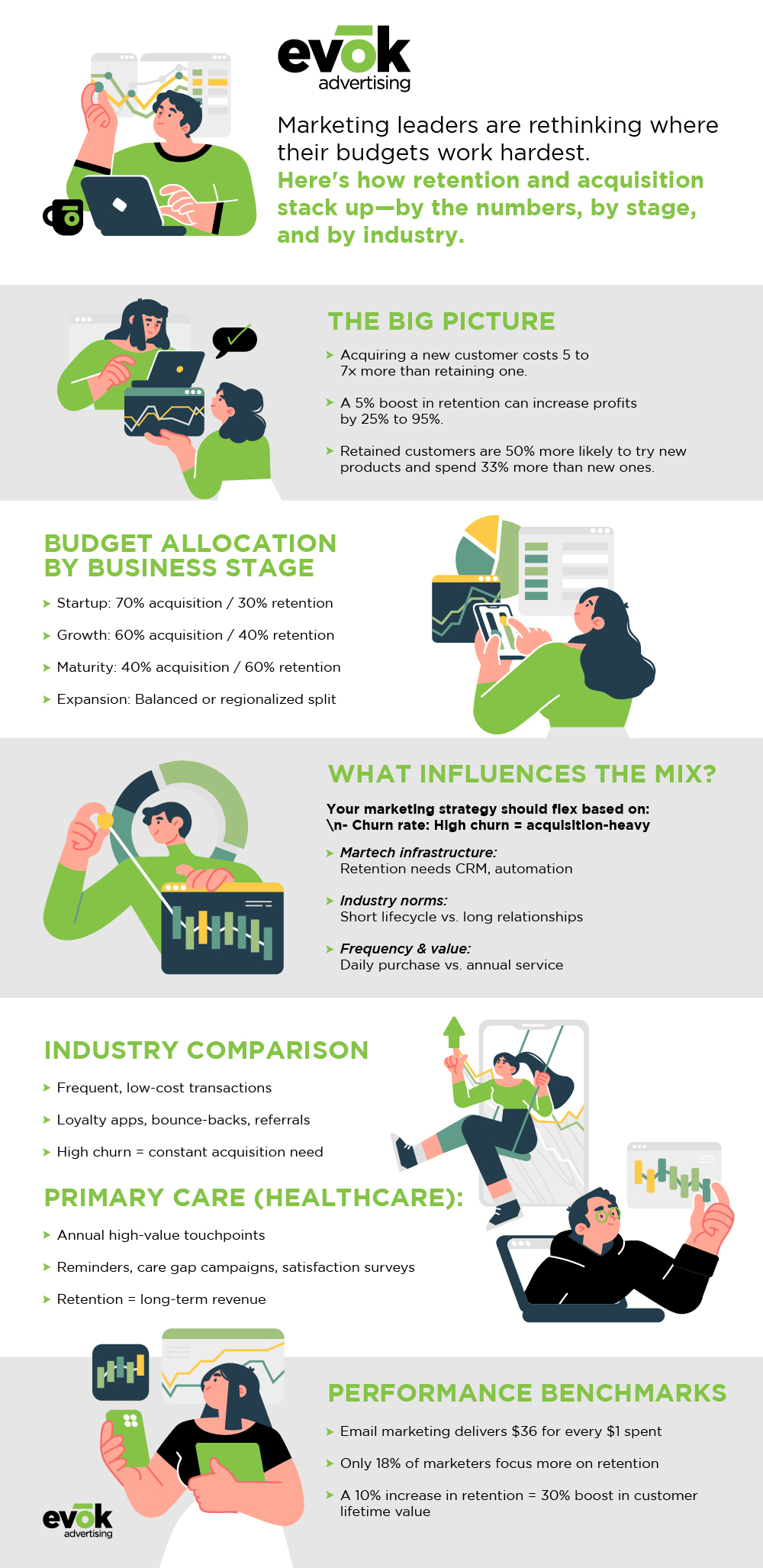

While there’s no universal formula, a useful framework for marketing budget allocation is to align spend with business maturity:

- Startup/Early Stage: 70% acquisition / 30% retention

- Growth Stage: 60% acquisition / 40% retention

- Mature Stage: 40% acquisition / 60% retention

- Expansion/Scaling: Balanced 50/50 or vary by region/product

Additionally, consider your CLTV:CAC ratio as a decision point. A ratio of 3:1 or higher is generally healthy, meaning the lifetime value of a customer is at least three times what it costs to acquire them.

Why does retention have a better ROI?

Marketing research shows that prospects need to see an ad multiple times before engaging: typically 5 to 7 impressions before they even remember a brand, and as many as 20–50 touches before purchase, depending on the buying stage. This frequency builds awareness, recall, and trust, especially important when selling high-consideration products. For a credit union looking to cross-sell auto loans to existing members, this dynamic matters: those who’ve already been exposed to brand messaging through their checking account experience will require far fewer ad impressions to convert. When contrasted with cold audiences, who may need dozens of impressions across paid and organic channels before even considering an auto loan, it’s clear why retention is cheaper. Learn more about credit union marketing here.

A research paper published by Bain & Company shows that increasing customer retention rates by 5% can increase a business’s profitability by 25% to 95%. It’s also less expensive to nurture members through automated email campaigns or app notifications than to run acquisition-focused display or search ads. These channels accelerate the purchase path because existing members begin with a higher baseline of brand experience and trust. They’re familiar with the loan application process, have already received customer service touches, and likely have had positive interactions with online account tools. The result? Shorter sales cycles, higher conversion rates, and lower incremental marketing investment per loan issued. This efficiency means retention tactics such as renewal reminders, special offers, or personalized outreach drive more repeat purchases at a reduced CAC while reinforcing loyalty and member satisfaction.

What additional factors should be considered?

Customer acquisition and retention aren’t just strategic levers; they’re functions of your market realities, your operational model, and your brand’s maturity. One of the most overlooked factors in marketing budget allocation is structural readiness: not just how you intend to grow, but whether your organization is equipped to do so efficiently. For example, a brand with fragmented or siloed data won’t be able to execute personalized, lifecycle-driven retention campaigns, even if it invests heavily in retention tools. On the flip side, acquisition campaigns without proper funnel optimization, CRM integration, or attribution modeling often generate expensive leads with little long-term value. For seasoned marketers, this isn’t about choosing one over the other, it’s about sequencing and supporting each strategy based on the operational infrastructure that enables ROI.

Churn rate adds another layer of complexity. Harvard Business Review published an article diving deep into the considerations around this metric in 2024. A business with high churn must continuously invest in acquisition just to maintain baseline revenue, while one with strong retention can reinvest in upselling or expanding share of wallet. But not all churn is created equal. Subscription services, hospitality, healthcare, and retail each define churn differently. Examples include cancellation, lapsed visits, patient attrition, or dormant buyers. The definition informs your metrics and your urgency. If you’re not adjusting acquisition and retention spend in direct correlation with customer lifecycle behavior and churn velocity, you’re likely misallocating budget. A retention strategy that performs well in a low-churn environment may collapse under a high-churn model if the frequency and messaging cadence aren’t recalibrated.

Consider the contrast between a local restaurant and a multi-location healthcare group marketing primary care services. A restaurant owner faces high customer turnover, variable visit frequency, and tight margins. Acquisition through social ads, limited-time offers, or referral incentives is critical for keeping traffic steady, especially in peak seasons or competitive corridors. While loyalty tools can help, the business depends on a constant influx of new diners, so the measured KPIs should reflect that. Meanwhile, a healthcare marketer managing primary care practices is dealing with a longer customer lifecycle, strict HIPAA boundaries, and infrequent but high-value touchpoints. Here, retention is paramount. Annual wellness visit reminders, post-visit email follow-ups, and patient portal engagement tactics are more effective and more compliant than awareness ads. And because switching providers is often driven by experience—not price—the brand’s ability to deliver continuity, convenience, and communication drives retention more than any media buy ever could.

Marketing Benchmarks Worth Noting

- The average ROI for email marketing is $36 for every $1 spent.

- Only 18% of companies focus more on retention than acquisition, despite the known cost advantages.

- Increasing customer retention by just 10% can lead to a 30% increase in customer lifetime value.

Incorporating benchmarks like these into quarterly planning or executive reporting can help marketers make the case for shifting budget priorities.

In conclusion, there’s no universal formula for how much to invest in customer acquisition versus retention, and that’s exactly the point. The most effective marketers know that budget allocation isn’t about preference; it’s about precision. It requires a clear understanding of lifecycle stage, infrastructure readiness, industry dynamics, and performance metrics like CAC, CLTV, and churn. While acquisition gets attention for fueling short-term growth, retention drives the long-term margin and brand equity that make growth sustainable.

The smartest marketing leaders don’t ask which lever to pull; they ask when, how, and with what supporting systems. Whether you’re scaling a healthcare brand with complex compliance needs or filling seats at a new restaurant, your strategy should reflect your customers’ behavior, your business model, and your team’s ability to deliver on the experience promised. Acquisition is how people find you. Retention is why they stay. And both, when orchestrated well, are how you win.

Need a Strategic Partner?

If you’re rethinking your marketing budget mix or struggling to scale both acquisition and retention with clarity, we can help! From building customer journey frameworks to deploying full-funnel marketing campaigns, we work with brands across industries to turn insights into action, and action into outcomes.