Credit Union Trends: How to Get New Members & Opened Accounts in 2022

We may be almost halfway through 2022 but the push to increase NAOs is a year-round area of focus for credit unions. As you evaluate your marketing strategies and determine what is working and what must be adjusted, our team has gathered the latest data from our research partners to act as a guide. These findings focus on the types of accounts consumers are looking for through the rest of the year, what motivates consumers to open an account, and overall consumer attitudes towards financial institutions.

Keep reading for your mid-year check-in and a look at what’s still trending in the credit union and financial industries for 2022.

One in two consumers plan to open a new account in 2022

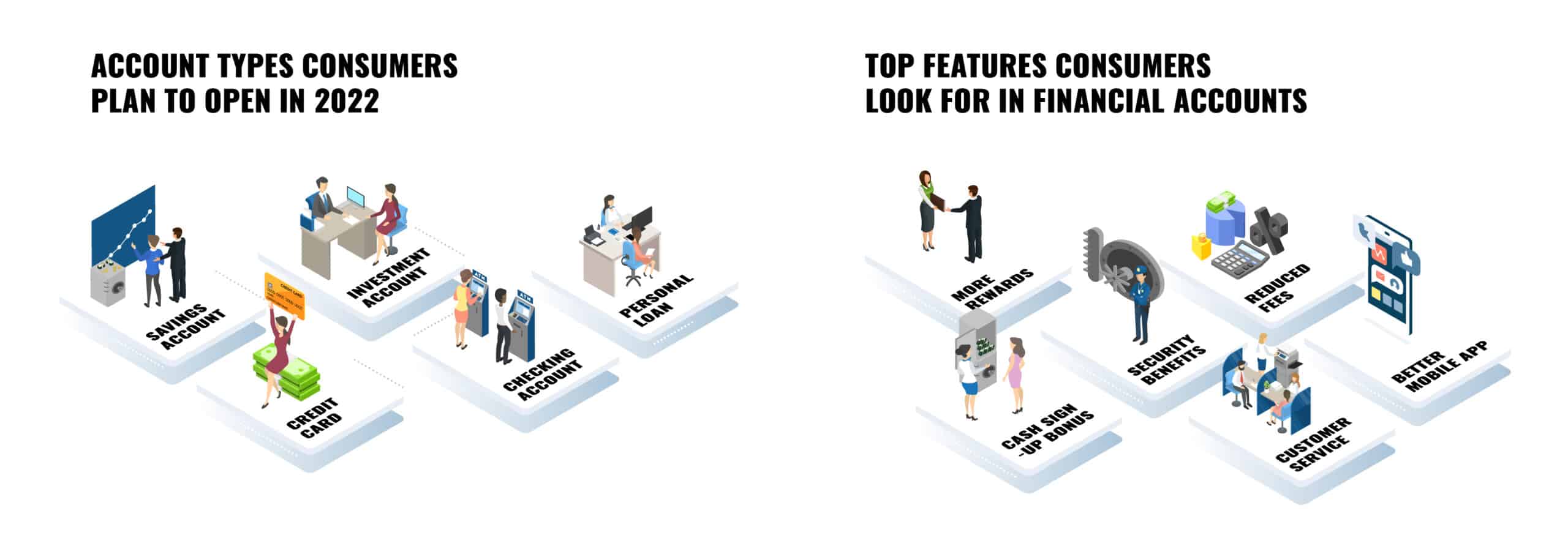

In terms of new financial services accounts planned for 2022, 50% of consumers indicated that they intend to open at least one type of account, suggesting a significant desire for a more diverse financial portfolio in the coming year. A savings account was the most popular new account option, with 21% of consumers planning to start one in 2022. Only 73% of adults in the United States have a savings account, leaving around a quarter of the population without one. In this category, many savings account holders are likely aiming to improve their savings potential, as growing savings was the number one goal for US consumers in 2022.

Investment accounts and credit cards trailed closely behind savings accounts, with 20 percent and 19 percent of consumers planning to open them, respectively. Gen Zers are more interested in credit cards than any other generation, with 35% wanting to open a new card this year. This is especially interesting because Gen Z customers have demonstrated a preference for debit cards, with only 15% picking credit cards as their preferred method of payment. Credit cards, on the other hand, are set to remain ubiquitous, with more than one-third of Gen Zers planning to open a card by 2022. These starter card products will most likely act as credit-building tools for a segment of the population that is still wary of credit card debt.

Rewards are a top reason why consumers choose an account, but two others trail closely

Increased rewards, cash signup bonuses, and a reduction in rates or fees are three key features leading consumers to seek new financial services accounts in 2022. These cornerstone qualities translate to three motivating factors consumers consider when choosing a new product: a short-term source of value (sign-up bonus), long-term earning potential (increasing rewards), and aversion to unfavorable features (reduced rates or fees). The fact that each of these features is tied for first place shows that products that can provide at least two of these advantages will be highly valued by customers.

Consumers regarded other features as less important, characterizing them as niche options or nice-to-have perks that aren’t particularly compelling. Specific reward kinds, such as vacation rewards or rewards in a new category, were far less popular than just boosting rewards earned in general, suggesting that, while customers may want to be rewarded in personalized ways, pure value still reigns supreme. Security features, customer service, and mobile app experience are all important aspects of financial service goods but competing institutions may find it more difficult to demonstrate real improvements in these areas than in the value-driven areas of bonuses, fees, and rewards.

However, when it comes to customers who want to open a checking account this year, mobile apps are twice as likely to motivate them as the typical consumer, demonstrating how new account holders prefer to engage with their accounts. Security and customer service are also given significantly greater weight, implying that consumers looking for checking accounts want a reliable partner who can provide a true relationship rather than just a financial service.

Consumers are looking to credit unions for their financial needs

When asked where consumers would like to open a new financial account, credit unions attracted the most attention, with 35% of consumers wanting to connect with a credit union. Credit unions are likely to have an advantage over larger organizations perceived as impersonal and monolithic because of their strong reputation for customer care and individual relationships. Further, credit unions’ ability to offer higher interest rates on bank accounts may represent a demonstrable advantage to a client base that prioritizes saving in 2022.

When comparing institutions, young consumers, who are the most likely to open new financial services accounts in 2022, are also the most institutionally neutral. Millennials and Gen Zers will evaluate fintech and technology companies at virtually the same rate as banks and credit unions, leveling the playing field for new entrants to the financial services market. Almost a third of Millennials would create an account with an online-only bank or fintech company, and 28% would open a financial services account with a tech company that isn’t particularly focused on finance, such as Google or Apple. For credit unions, the younger generations’ openness to fintech means added competition for this market that may be addressed by implementing targeted marketing strategies reflecting this segment’s preferences.

Consumers are looking for convenience, which means opportunities for cross-selling

A common thread among consumer preferences was an overwhelming propensity and desire to maintain financial accounts in one location. When it comes to extra financial services, 80% of customers prefer to utilize their current bank, indicating that banks have a strong chance to cross-sell to their existing member base. Furthermore, 64% of consumers would want to have all their financial services available in one mobile app.

When it comes to their mobile app experiences, financial institutions must meet two largely contradictory concepts: consumers are still concerned about their financial data being held on apps, but they increasingly prefer to have all their financial accounts available in one app with a seamless digital experience. Consumers of all generations are concerned about their financial data being saved on mobile apps, with at least two-thirds of all consumers worrying about security. The preference for a seamless experience between financial services accounts, on the other hand, is substantially younger, with 84% of Millennials favoring it vs only 41% of Baby Boomers.

How does your new member marketing strategy stack up?

Staying up to date on the latest developments in consumer attitudes and behaviors is key to ensuring your CU marketing strategies evolve as needed. If, after reading through the above credit union trends with an NAO focus, you have questions regarding your institution’s marketing direction, we’re here to help.