Global Financial Literacy Changes: How Gen Z and Millennials Are Changing the Game

Young in age but not in experience, Millennials, and Gen Zers have lived through financial crises, a global pandemic, and major societal shifts. As such, their personal finances reflect these conditions, as do their attitudes toward financial institutions. Today, we’ll dig into how these younger generations compare to one another in terms of financial planning and decisions, and the role of financial literacy in their day-to-day lives.

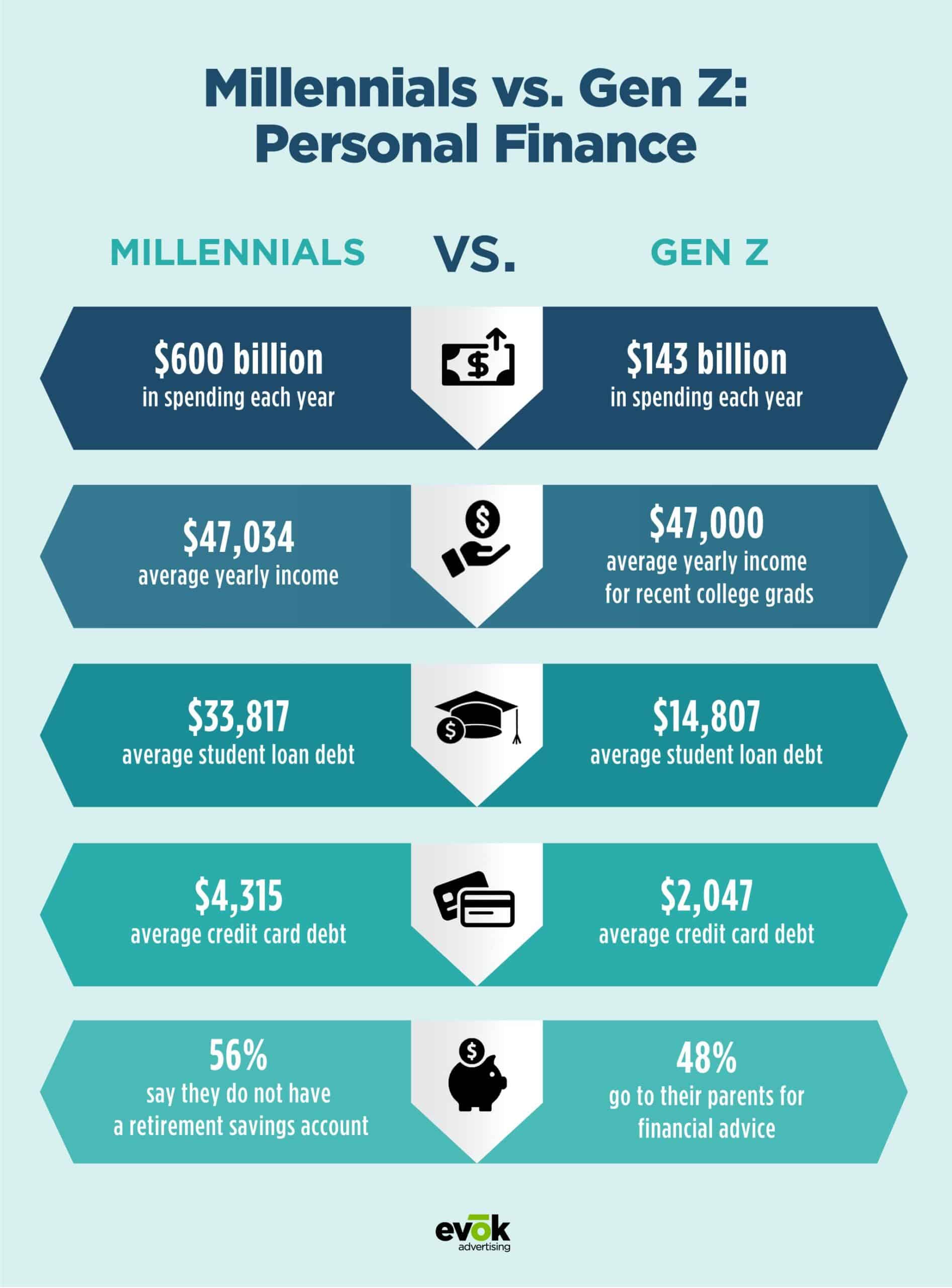

Gen Z vs. Millennials: Comparing Personal Finances

Although Gen Z and Millennials are roughly within the same age group, their attitudes toward personal finances show some marked differences.

Millennials have different attitudes towards saving money from earlier generations, which has been influenced by both their upbringing and economic climate during their adolescence. These differences include taking on student debt at a higher rate than previous generations and having fewer savings for retirement or emergencies. Millennials also seem to be more confident with credit cards than other generations, but they also appear to be more aware of the risks involved with using them while avoiding any potential pitfalls that could lead to bankruptcy. As millennials grow up and start families themselves, these same attitudes extend into their children’s lives as well.

In the last few years, Gen Z has been gradually entering adulthood. These emerging adults have stronger values when it comes to spending and saving money, which is likely due to the economic recession that most were born into. They also show an increased interest in financial literacy and planning for their future – perhaps also due to the tough economy, they grew up in.

Gen Z is conservative with their finances. They’re less likely to buy luxury items or take out loans for living expenses. However, 73% of them are expected to graduate with some student loans and almost 40% have had to refinance credit card debt.

These two generations can’t seem to agree on much when it comes to topics like fashion and pop culture, but when it comes to finances both groups find themselves in similar situations: struggling with student debt while trying not to live paycheck-to-paycheck.

Why Younger Consumers Leave Financial Institutions

It’s a well-known fact that Millennials and Generation Z are more tech and marketing savvy than their parents. They’re open to new ideas, but they don’t want to be sold anything, which can make life difficult for marketers. However, there is one thing that many of these generations have in common: how often they switch banks.

Millennials and Gen Zers are more educated than ever before. They’re more informed about the impact of their money decisions on society and the planet. As a result, they’re switching banks at unprecedented levels to find one that supports their values. Sixteen percent of Millennials have switched banks in the past 12 months, which is four times more often than older consumers. Plus, 20 percent intend to switch banks in the future, driven to do so by more competitive interest rates, high fees, and inconvenient branch locations.

Increasing Member Retention for Gen Z and Millennials: What It’s Going to Take

With these stats in mind, it’s no wonder why marketers are worried about how to keep this generational cohort engaged enough to stick around long-term; after all, there are over 80 million Gen Zers and 58 million Millennials in the US alone! And while some might say that this is just a numbers game—that as long as you have more new customers than old ones then everything is fine—credit unions must be aware of what younger members want from their financial institutions in order to retain their business.

In a recent study by PwC, Gen Z and Millennials ranked “a good value” as their top reason for choosing a financial institution. This means it’s important not only to offer competitive rates but also to be transparent about fees and provide personalized service through online banking or mobile apps. These members are looking for an institution that will not only provide them with excellent customer service but also allow them to bank in the way they prefer; which may include 24/7 availability or account aggregation (combining all your accounts into one login).

The credit union industry has always had a strong focus on member retention. The old adage of “once you have them, they’re yours forever” rings true for many credit unions focused on their members’ financial stability. But with Gen Z and Millennials having different needs than Baby Boomers and Generation X, it’s time to re-evaluate what the most effective ways are to retain this new generation of members.

The Role of Financial Literacy in Marketing to Millennials and Gen Z

Millennials and Gen Z want convenience, transparency, and control of their finances. They also crave information about everything from savings rates to retirement options. Financial literacy is crucial for marketing to Millennials and Gen Z as it shapes all of their financial decisions including credit card use, insurance coverage, investing habits, etc. So, how can credit union marketers deliver on the demand for education-focused yet engaging content for younger members? Meet your audience where they are.

Let Their Peers Lead Your Efforts

Influencer marketing has proven a boon for marketers looking to connect to their audiences using authentic, peer-led outlets. Credit union marketing has seen slower adoption of this channel, however, we’re seeing a rise in the popularity of financial tips on platforms like Instagram Reels and TikTok. Ensure your credit union is getting in on the action with “lifehack”-style content containing actionable tips.

Consider Topics Beyond Traditional Financial Education

Credit card basics and how to set up your monthly budget will always be relevant subjects to cover in efforts to improve financial literacy. To serve your Millennial and Gen Z audiences at an even higher level, lend your expertise on up-to-the-minute topics like cryptocurrency, starting an investment portfolio, and how to file taxes for your side hustle.

Millennials and Gen Zers have a unique lens on finance due to their experiences with financial crises, global pandemics, and societal shifts. As such, these generations’ needs differ from those of previous ones when it comes to banking services as well as attitudes toward banks. In order for credit unions to market effectively towards Millennials/Gen Zers, they must align marketing strategies around the shifting preferences among younger patrons in this era of digitalization.