Fintech and The Banking World: Marketing in a COVID-19 World

During these disruptive times of the coronavirus crisis, there is no marketing playbook. Workers are being sent to work from home, businesses are closing, and consumers are experiencing more stress than could have imagined. Businesses in all industries are scrambling to connect with customers and discuss how they are responding to COVID-19. The coronavirus atmosphere demands fresh ideas on what financial marketers should be doing, and judgment for what it shouldn’t.

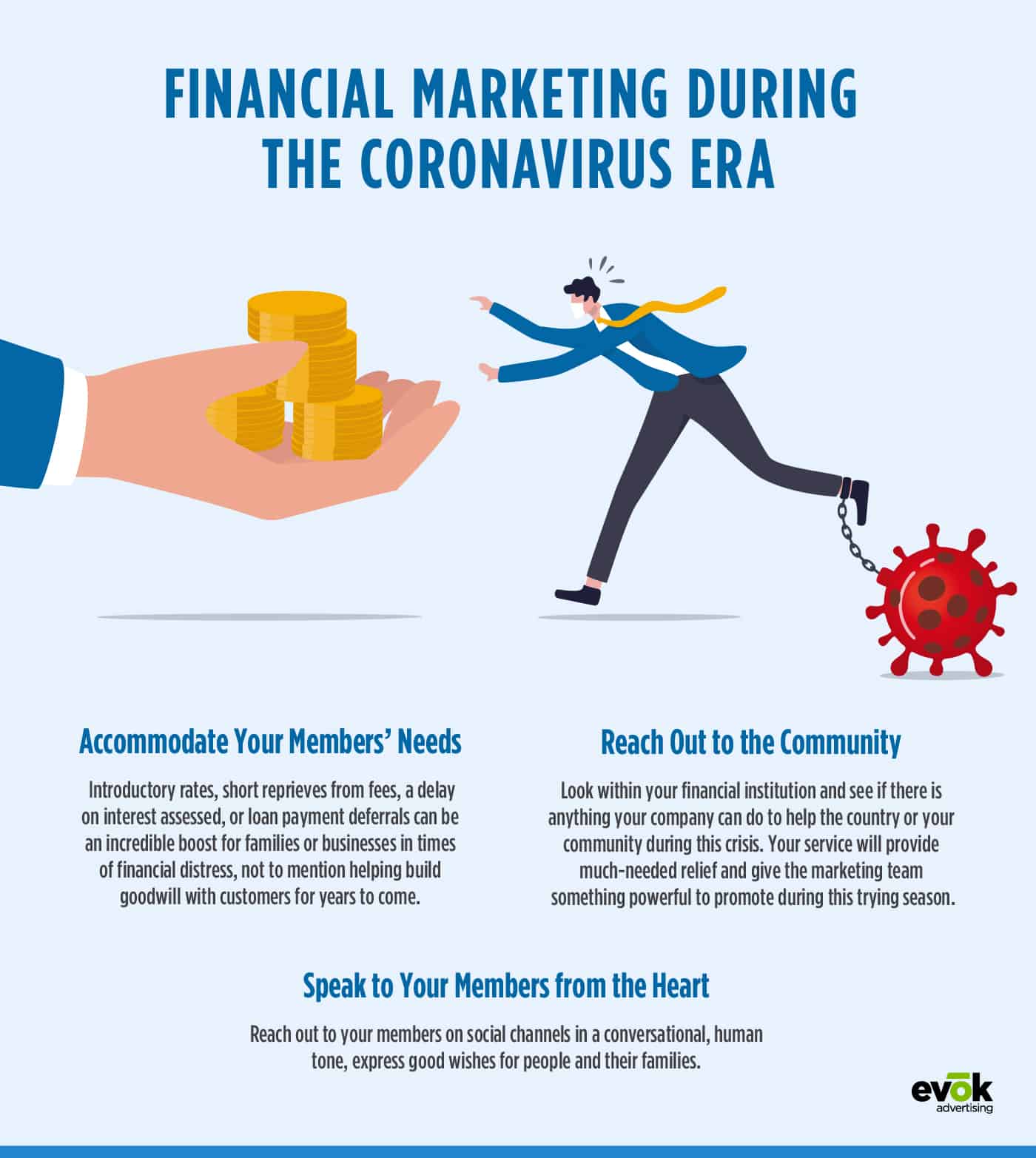

Financial Marketing During the Coronavirus Era

- Speak to Your Members from the Heart – Reach out to your members on social channels in a conversational, human tone, express good wishes for people and their families.

- Accommodate to Your Member’s Needs – Introductory rates, short reprieves from fees, a delay on interest assessed, or loan payment deferrals can be an incredible boost for families or businesses in times of financial distress, not to mention helping build goodwill with customers for years to come.

- Reach Out to the Community – Look within your financial institution and see if there is anything your company can do to help the country or your community during this crisis. Your service will provide much-needed relief and give the marketing team something powerful to promote during this trying season.

Negative Impact of Coronavirus on Banking and Fintech

The impact of the coronavirus crisis is impacting both financial markets and consumer behavior. Canceled flights, closed stores, and social distancing are expected to result in a drop in transaction volume at all levels of the economy. Fear, panic, and quarantine measures are also heavily impacting consumer spending.

There has been a significant shift to safer investments by consumers, which could negatively impact VC funding of existing and new fintech companies. This decrease of financing to non-traditional financial services firms could force many firms to find collaboration or investment partners from traditional organizations. Both Visa and MasterCard have warned shareholders about a projected sharp slowdown in cross-border business and travel-related spending, cutting their expected sales by 2% to 4%.

The impact of the expected drop in transactions at all levels of the economy worldwide will affect financial service companies, especially for fintech firms in the payments sectors. This means fewer fees collected by companies on the payments side of the fintech sector, like Square, Stripe, or Chime impacting profitability. The supply chain shortage could also impact firms like Square, which rely on digital services to support transaction processing. Some early-stage fintech companies may have to shut down.

Positive Impact of Coronavirus on Banking and Fintech

But not all is bad during this coronavirus outbreak. Consumers’ desire for digital banking services will increase, forcing many traditional financial institutions to fast-track digital innovation efforts. The fear of getting infected and quarantine measures are going to keep customers away from financial institution branches. The coronavirus is a great time to make a move to a germ-free branchless banking experience. Many legacy banks and credit unions may partner with fintech firms for assistance in bringing better digital banking solutions to the marketplace.

Additionally, the World Health Organization has encouraged contactless payments as opposed to central banks and credit unions resorting to quarantining and disinfecting physical bills that come in. Contactless payment is a much safer and more convenient alternative to contaminated cash. Expect a significant increase in the total volume of contactless payments as the pandemic continues, and even after this passes.

Financial Marketing in a COVID-19 World

Joe Sullivan, CEO of Market Insights, believes part of the duty of banks and credit unions in this uncertain period is to ditch all traditional marketing for the time being. Now is not the time to be pushing the product, instead, customers want to know what you are going to do to improve their lives in the next 30 days – not 20 years from now. With that in mind, we’ve collected some best practices for financial marketing during the disease outbreak.

Speak to Your Members from the Heart

Financial institutions are already personally involved in the lives of their customers and enjoy a degree of built-in trust. Now more than ever is the time for a friendly check-in. Reach out to your members on social channels in a conversational, human tone, express good wishes for people and their families.

With social distancing measures being implemented full force through the United States and the world, your customers are craving interaction and human touch. More than ever, people may want to have a discussion about their particular situation with a human banker. Make a plan for your financial advisors to reach out to their members personally, in real-time, maybe through a call or video conference. Ask them how they’re doing, what their major concerns are, and how your establishment can help them during this time.

Accommodate to Meet Your Member’s Needs

There are nearly 67 million Americans working in jobs that are at high risk of layoffs. According to St. Louis Fed projections, the coronavirus economic freeze could cost 47 million jobs and send the unemployment rate past 32%. From personal health conditions to losing income, to the wholesale disruption of life as we know it, your members are liking facing stressful times, and many families may be worried about how they’re going to put on the table while paying their mortgage. The federal government has stepped in to provide some economic stress reduction, but financial institutions have a tremendous opportunity to help members and customers more.

As the term of this coronavirus challenge lengthens, executives should consider if there are fee waivers, bonuses, or promotions that the institution can offer to help reduce the economic toll on account holders. Introductory rates, short reprieves from fees, a delay on interest assessed, or loan payment deferrals can be an incredible boost for families or businesses in times of financial distress, not to mention helping build goodwill with customers for years to come.

Reach Out to the Community

On March 18th, online small business lender Kabbage launched a service that allows any business to sign up and sell gift certificates for future use at their retail locations. Small businesses on the platform can sell gift certificates ranging from $15 to $500. Revenue is then received by the small business within one business day of purchase. Frohwein said the platform was created by 100 Kabbage employees who came together over three days to prepare the launch the following week. The company partnered with other fintech companies, like Finix, Lendio, and Fundera that helped get the site up and running in such a short period of time.

Look within your financial institution and see if there is anything your company can do to help the country or your community during this crisis. Consider adopting a cause during these uncertain times when so many are in need. Team up with a nonprofit. Accept donations to support health care response capacity, address food insecurity, increase access to learning as a result of school closures, or provide support to vulnerable populations in your community. Your service will provide much-needed relief and give the marketing team something powerful to promote during this trying season.

This pandemic has given financial marketers an opportunity to experiment with new digital marketing strategies that they otherwise would not have had the time or would be considered too risky. Well, we’re living in the time all about risk-taking, especially when we’re trying to engage with our customers and members in a way that it relatable and meets their current needs. Don’t forget that now is not the time to push products but instead, create brand awareness. Build relationships with your members, find new ways to reach them and make sure to stay safe.