Landing Page Optimization for Credit Unions: Turning Rate Shoppers into New Member Accounts

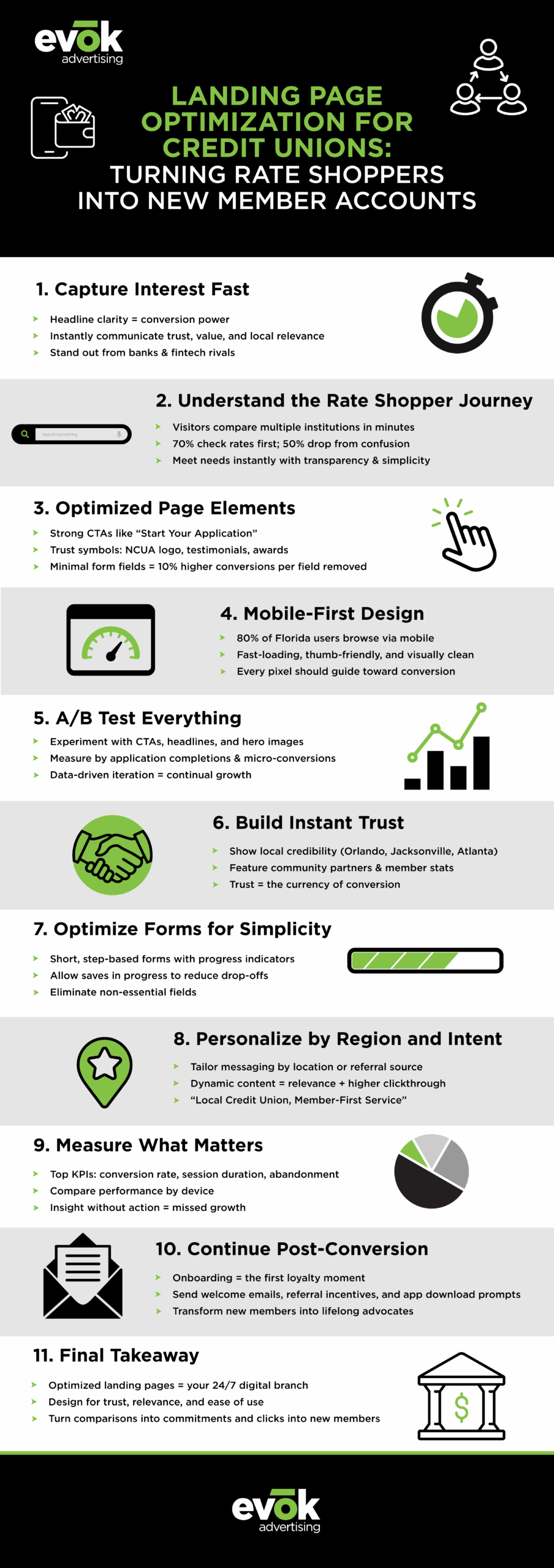

In today’s hyper-competitive financial landscape, your website is more than a digital front door—it’s your most powerful sales channel. Optimizing every digital touchpoint for credit unions has become essential for attracting and converting the modern “rate shopper.” These consumers compare rates, products, and benefits across multiple institutions before making a commitment. In a few clicks, your landing page must prove your credit union’s value, trustworthiness, and ease of use.

The credit union marketing landscape is shifting toward measurable conversion strategies. Increasingly, forward-thinking institutions are partnering with credit union marketing agencies to refine credit union landing page optimization, enhance content, and create seamless journeys from first impression to new member account—resulting in reduced friction, stronger engagement, and higher credit union conversion rates.

In today’s hyper-competitive financial landscape, your credit union’s website is far more than a mere digital front door—it is your most potent and strategic sales channel. To thrive, optimizing every digital touchpoint has become not just beneficial, but essential for attracting and converting the modern “rate shopper.” These sophisticated consumers are adept at comparing rates, products, and benefits across numerous institutions with just a few clicks. Therefore, your landing page must instantly and unequivocally communicate your credit union’s exceptional value, unwavering trustworthiness, and unparalleled ease of use, proving its worth within moments of a visitor’s arrival.

The credit union marketing landscape is undergoing a profound shift, moving decisively toward data-driven, measurable conversion strategies. In this evolving environment, forward-thinking institutions increasingly recognize the critical advantage of partnering with specialized credit union marketing agencies. These partnerships are instrumental in refining credit union landing page optimization, elevating content quality, and meticulously crafting seamless member journeys.

The goal is to guide prospective members effortlessly from their first impression to successfully opening a new member account, resulting in significantly reduced friction, stronger engagement, and ultimately, higher credit union conversion rates. This strategic approach ensures that every marketing effort is effective and directly contributes to the credit union’s growth and member acquisition objectives.

Why Landing Page Optimization Is Critical for Credit Union Member Acquisition

Landing pages are the unsung heroes and workhorses of modern credit union digital marketing campaigns. These dedicated web pages are meticulously designed to capture visitor information and guide them towards a specific action, such as applying for a loan, opening a new account, or signing up for a newsletter. Whether promoting competitive auto loan rates, enticing checking account benefits, or exclusive credit card offers, these pages often determine whether a curious website visitor transforms into a valued, long-term member. Yet, in an increasingly competitive financial landscape, many credit unions still mistakenly treat their websites as static informational resources rather than dynamic, high-performance conversion funnels. This oversight can significantly hinder their member acquisition efforts and overall growth.

According to industry leaders, top-performing financial institutions understand that effective landing pages are not just an afterthought; they are strategically designed to deeply align with user intent at every step of the member journey. Each page is carefully crafted to simultaneously educate potential members about the credit union’s offerings, subtly persuade them of its value proposition, and ultimately convert them into new members—all within a seamless and intuitive online experience. In today’s digital-first world, landing page optimization for credit unions is no longer a luxury or an optional add-on; it is a foundational, indispensable component of any successful and sustainable member acquisition strategy.

Think of each optimized landing page as a digital branch that never closes, is open 24/7, and is ready to serve. Unlike a physical branch, however, these digital touchpoints can be infinitely personalized and dynamically tailored. Each page should feature strong, attention-grabbing headlines that immediately communicate value, clear and compelling calls-to-action (CTAs) that guide visitors to the next step, and an intuitive design flow that minimizes friction and maximizes engagement. Whether a prospective member arrives from a targeted search engine ad, a visually engaging display ad, or a compelling social media campaign, their experience on the landing page should feel purposeful, highly relevant, and utterly friction-free, ensuring they find precisely what they’re looking for and are encouraged to take the desired action.

Understanding the Rate Shopper Journey: From Search to Application

Today’s member prospects, especially in Florida’s competitive financial markets, are sophisticated, digitally fluent, and selective. A typical rate shopper compares multiple institutions online before deciding where to apply for an account or loan.

The journey begins with a Google search, an ad click, or a referral link. Once on your site, these visitors scrutinize your rates, credibility, and convenience. Effective credit union website optimization aims to meet potential members where they are—answering questions, reinforcing trust, and making the application path crystal clear.

Key conversion insights:

- 70% of credit union site visitors look for rates first.

- 50% abandon their applications due to confusing navigation or unclear eligibility.

- Only a fraction returns once they leave the page.

That means you have seconds to capture interest, and minutes to convert it into measurable action.

Essential Landing Page Elements That Convert Visitors into Members

Optimized financial service landing pages require balance. They must communicate compliance-approved messaging while still engaging emotionally and visually. Clarity and relevance drive conversions more than any other factor.

Consider these essential elements for credit union landing page optimization:

- Headline: Immediate clarity and differentiation. Your value proposition should stand out from banks and fintech competitors.

- Subhead: Supportive, benefit-driven explanation connecting emotional appeal to tangible outcomes.

- Visual hierarchy: Prominent images of community members or local engagement build familiarity and warmth.

- Trust symbols: Member testimonials, accreditations, awards, and NCUA logos reinforce legitimacy.

- Strong CTAs: Directional, benefit-focused language (e.g., “Start Your Application” vs. “Submit”).

- Minimal form fields: Data shows that every extra field reduces conversion rates by up to 10%.

When every page is designed to capture intent, the credit union’s lead conversion process becomes far more predictable and scalable.

Headline and Value Proposition: Making Your Credit Union Stand Out Instantly

A high-performing landing page begins with clarity. The headline is not the place for jargon or brand slogans—it is your instant proof point. For example, “Earn More with a Checking Account That Belongs to You” outperforms vague phrases like “Experience Better Banking.”

Your credit union marketing strategy should center this value proposition throughout the page. Relevance and simplicity have a significant impact on the perception of first-time visitors. Every element—from the hero image to the first CTA—should reinforce a single message: why joining your credit union offers tangible, local, and member-first benefits.

Call-to-Action Best Practices: Guiding Visitors from Interest to Application

Call-to-Action (CTA) elements are pivotal in converting interest into tangible action on financial institution landing pages. They serve as the primary conversion triggers, guiding potential customers through the application funnel. For optimal effectiveness, CTAs should not be isolated elements but integrated seamlessly and strategically throughout the user experience.

This means appearing not just once, but multiple times across the landing page, embedded naturally within product details, and consistently reiterating the same clear next step. This strategic repetition reinforces the desired action and provides multiple opportunities for conversion as users engage with the content.

Effective credit union CTA optimization involves several key best practices designed to maximize engagement and reduce friction in the application process:

- Using High-Contrast Buttons and Action-Oriented Language: Visually, CTAs must be easily distinguishable from the surrounding content. This is achieved through the use of high-contrast buttons that draw the eye and clearly indicate an interactive element. Beyond aesthetics, the language used within the CTA is equally crucial. It should be action-oriented, directly instructing the user on what to do next, such as “Apply Now,” “Get Started,” or “Open an Account.” Vague or passive language can lead to hesitation and missed opportunities.

- Presenting Multiple Low-Friction Actions (e.g., “Estimate My Rate,” “See If I Qualify”): Not all visitors are ready to commit to a complete application immediately. Offering a range of “low-friction” CTAs can significantly improve conversion rates by catering to different stages of the customer journey. These options might include “Estimate My Rate,” “See If I Qualify,” “Learn More,” or “Contact Us.” These less-committal actions provide value and allow users to explore their options without feeling pressured, ultimately building trust and guiding them toward the primary application CTA.

- Placing Sticky CTAs for Mobile Users Who Scroll Deeply: Mobile users represent a significant portion of website traffic, and their browsing habits often involve extensive scrolling. To ensure CTAs remain visible and accessible regardless of how far a user scrolls, implementing “sticky” CTAs is essential. These CTAs remain fixed on the screen (often at the top or bottom) as the user scrolls, providing a constant opportunity for conversion without requiring the user to scroll back up the page. This is particularly effective for long-form content or pages with numerous product details.

These refinements are critical for converting rate shoppers and other interested parties who might otherwise hesitate before completing an application. By making the path to conversion clear, easy, and continually accessible, financial institutions can significantly improve their conversion rates and ultimately acquire more customers. The goal is to remove any potential barriers and create an intuitive, guiding experience that transitions visitors smoothly from initial interest to a completed application.

Form Optimization: Reducing Friction in the Account Opening Process

One of the top causes of application abandonment is cumbersome, multi-step forms. 67% of users abandon forms before completing them. That’s a huge loss, but it doesn’t have to be. Simplify your forms: Reduce unnecessary fields and start with easy questions.

Credit unions should apply A/B testing to find the right balance of information and convenience. They should break long forms into digestible steps, clearly display progress indicators, and offer in-progress save options. Most importantly, they should remove or defer non-essential form fields to improve speed and reduce anxiety.

Delivering an effortless path to action is central to any credit union user experience upgrade.

Mobile-First Design: Meeting Members Where They Search (Credit Union Trends)

Nearly 80% of traffic to credit union sites comes via mobile devices. Consumers compare rates and begin applications during commutes, lunch breaks, or late-night browsing sessions.

A mobile banking optimization approach ensures interfaces adapt intuitively across all screen sizes. Focus on thumb-friendly navigation, simplified CTAs, compressed media, and lightning-fast load times. Mobile-first landing pages are no longer an adaptation; they are the standard for credit union website design.

Trust Signals and Social Proof: Building Credibility with First-Time Visitors

In financial marketing, trust is equivalent to currency. Social proof, such as reviews, testimonials, and membership statistics, helps potential members feel confident about their choice.

Prominent localization reinforces credibility: mention the number of members, showcase branch managers, and include logos from community partnerships. Trust builders signal authenticity and reduce perceived risk for those encountering your credit union for the first time.

A/B Testing Your Credit Union Landing Pages: What to Test and Why

Proper optimization is an iterative process. Credit union A/B testing should evaluate both design and behavioral factors to optimize the user experience.

Experiment with:

- Headlines and subheads that highlight different UVPs.

- Button colors and wording.

- Hero images or video banners.

- Placement of CTAs and testimonials.

Each test should have a measurable hypothesis tied to a credit union conversion rate metric, such as application completion, form submissions, or micro-conversions.

Data-driven experimentation allows CMOs to prove ROI from specific adjustments and justify future design investments.

Speed and Performance: How Page Load Times Impact Member Conversions

Landing page performance has a direct impact on membership growth. Pages that load slowly or behave inconsistently across devices trigger abandonment, particularly in urban markets where users expect instant access.

Optimize for speed by compressing files, minimizing scripts, and using local caching. Consider browser and geographic testing—especially when targeting large markets like Orlando, Jacksonville and Atlanta—to ensure uniform load times.

Regional Targeting: Optimizing for Local Credit Union Members

Regional SEO and local content personalization are at the heart of effective credit union content marketing.

Prospects in Orlando may respond to messaging about community lending programs, whereas Atlanta audiences may prioritize low auto loan rates.

A Credit Union Marketing Agency can help tailor landing page content dynamically, based on location, referral source, or campaign, to ensure maximum relevance. Combining local imagery, community partnerships, and personalized CTAs strengthens consumer connection and decreases bounce rates.

Measuring Success: KPIs Every Credit Union Marketer Should Track

Every optimized campaign must include performance tracking tied to business outcomes. The most impactful KPIs for credit union website optimization include:

- Conversion rate per product landing page

- Application abandonment rate

- Average session duration

- Bounce rate by device

- Lead-to-member conversion ratios

- Mobile vs. desktop performance insights

Insight without action is a wasted opportunity. Continuous measurement fosters a data-informed culture, where incremental gains lead to exponential improvements in new member accounts.

Member Onboarding Optimization: Continuing the Experience Post-Conversion

The experience shouldn’t stop at the “Thank You” page. Streamlined member onboarding optimization continues to nurture relationships, ensuring that newly converted members feel supported and engaged from joining.

Effective onboarding sequences should include:

- Personalized confirmation emails

- Mobile app download prompts

- Early engagement incentives (such as savings challenges or referral bonuses)

- Educational resources on digital banking tools

This ongoing communication strengthens retention and deepens loyalty, closing the loop on the whole digital membership experience.

Bringing It All Together

Landing page optimization isn’t simply about increasing clicks—it’s about aligning design, messaging, and user experience with the psychology of trust. When a credit union approaches its website as a marketing and service channel, it transcends transactional engagement and builds lifelong relationships.

At Evok Advertising, our team specializes in Credit Union Content Marketing and full-scale Credit Union Landing Page Optimization. We help financial brands create data-backed digital ecosystems that reduce application abandonment, improve member acquisition, and drive measurable ROI. Through precision targeting, A/B testing, mobile-first design, and persona-driven storytelling, we transform landing pages into growth engines.

Your website should be your top-performing branch—the one that never closes and converts around the clock. Contact us today to start building landing pages that turn rate shoppers into loyal members and transform your digital presence into measurable growth.