2022 Social Media Marketing Agency Tips for Credit Unions

One of the defining advantages credit unions have over traditional banks is their focus on meeting the needs of members rather than shareholders. While it’s no secret that social media is one of the fastest growing ways to market your product or service, credit unions have a unique opportunity to establish relationships and build trust with their members on these platforms because of their business model. Keep reading for industry tips and tricks on growing your social media platform and increasing membership through social engagement.

Promote Your Posts

Organic posts are great for building loyalty with your audience and cultivating an authentic-feeling online presence, but over the last few years, Instagram and Facebook have decreased the reach of organic posts in favor of promoting paid ads about your products and services. What does this mean for you? To improve the visibility of your posts, you’ll need to invest a little more into either crafting paid ads or boosting your organic posts that have been doing well with the fraction of followers that have seen it. This will help you reach a wider audience — and of course, you can still use the Ads Manager feature to make sure your message is being placed in front of the right eyes.

Pick the Right Platform

It’s a common adage in advertising that if you try to reach everyone, you’ll reach no one. That’s why it’s important to reach the right people by meeting them on the platform they use most. Instead of wasting your time and resources trying to reach Gen X through Instagram reels, decide which demographic you’re trying to reach and do some research on what social media platform they’re most likely to see your posts. For your convenience, here’s a few of the top demographics on each platform:

- Instagram: Gen Z and Millennials

- Facebook: Millennial and Gen X Women

- TikTok: Gen Z Girls

- Twitter: Millennial Men

- YouTube: Gen Z (But at least 50% of every demographic is on this platform!)

- LinkedIn: Gen X and Millennials

Set Goals and Craft Your Message

Everything you post should have a rhyme and reason so you can achieve measurable results and get the most out of your social media presence. A classic form of setting good goals is using the SMART method:

- Specific

- Measurable

- Attainable

- Relevant

- Timely

You and your team should decide what you want to achieve with your posting. Are you wanting to increase your Gen Z following by 15%? Are you wanting to interact with 30% of your membership base during your next campaign? By setting your intentions before you launch a campaign, you can easily track success and identify when you need to adjust to reach planned milestones.

Understanding your goals also helps you craft a message and set a tone for your target audience. For example, if your goal is to reach a younger audience, you’ll use less formal language and graphics that wouldn’t fit a campaign targeting Gen X.

Less Selling, More Connecting

As a general rule, people don’t want their feed to be filled to the brim with promotional content. While it’s important to push your financial services and raise brand awareness through promoted posts, there should be a portion of your next social media campaign that is dedicated to posts that make people feel like their peeking behind the curtain and seeing the true character and personality of your company. Content you can post that doesn’t feel like you’re selling something might include:

- Tips and tricks

- Member testimonials

- Behind the scenes content

- Shouting out partnerships

- Elevating blog posts

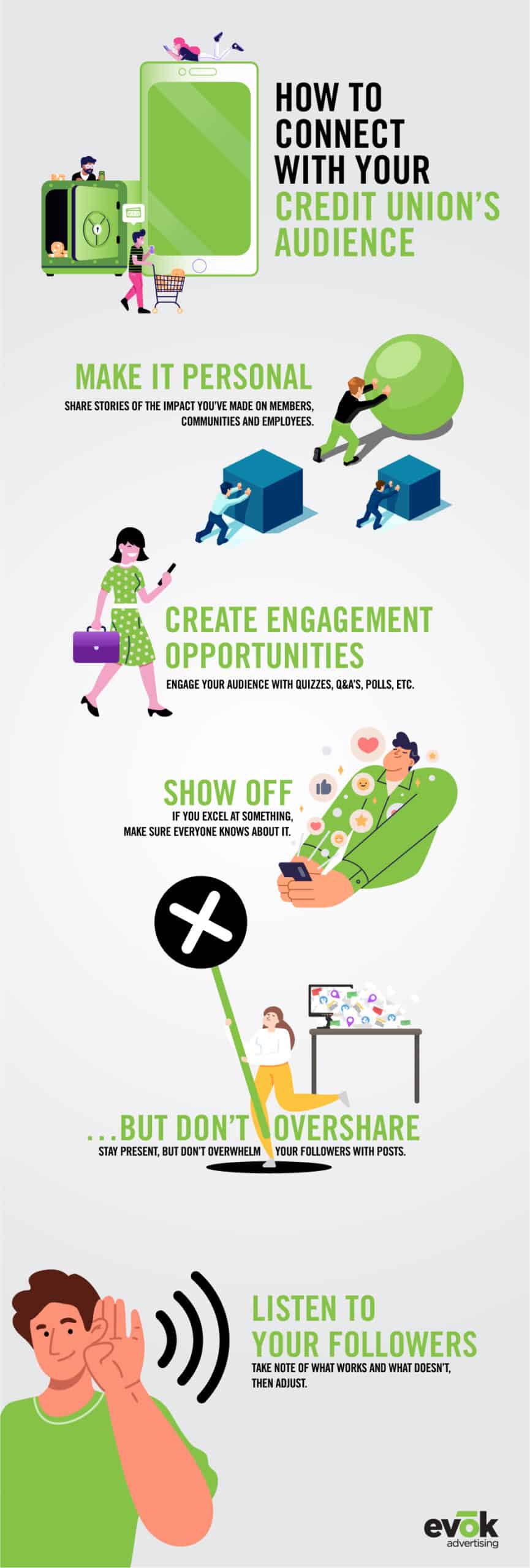

Engage with Your Followers

One of the best things about social media is that it creates two-way communication between businesses and their consumers. Take advantage of the opportunity to communicate directly to your audience by engaging with them consistently. This means liking and responding to comments, posting content that promotes engagement, and reposting on-brand content from credit union members or partners.

Call in the Pros

You’re great at what you do — servicing members and giving them the savings and rates they deserve, but that doesn’t always correlate to social media savvy. We know it can be challenge diving into a space where you feel like you don’t have much experience, and that’s why we’re here to guide you through the age of social media so you can capitalize on your online presence.

Consider evok your secret weapon — we’ve got the experience and resources to help you reach your social media goals, whether it’s to drive traffic to your site, expand your search engine marketing, find relevant content to publish, generate leads, or whatever else your credit union needs to get to the next level. To learn more about the latest and greatest in credit union marketing, check out our recent blogs or better yet, get in touch with our team today.