Digital Marketing for New Member Acquisition: What Credit Unions Need to Know

Credit Unions in 2021: An Overview

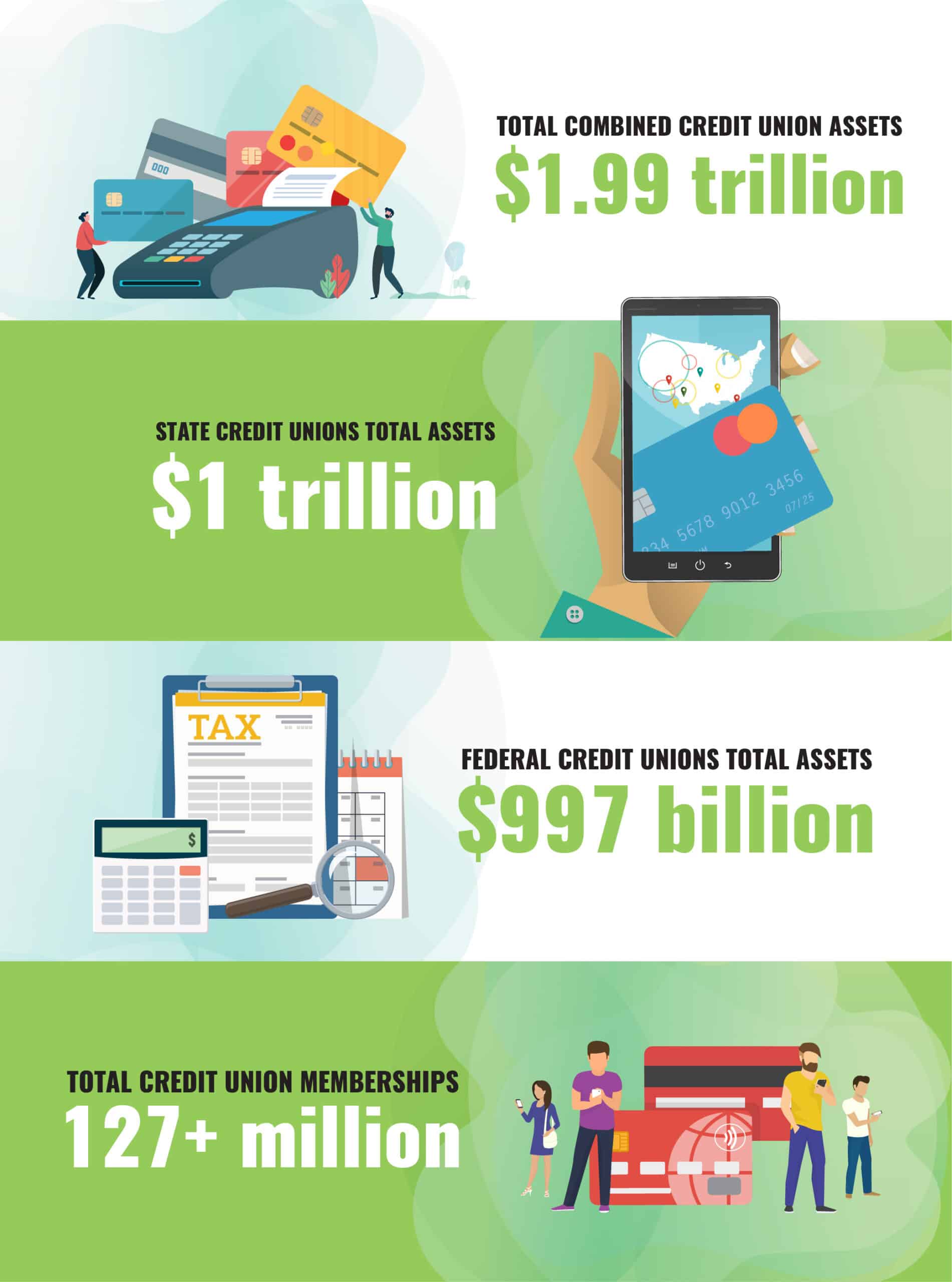

The credit union industry has seen tremendous growth over the past few years. As of 2021, combined total credit union assets total just under $2 trillion, with state credit unions surpassing $1 trillion in September 2021. As the industry grows, it will become increasingly crucial for credit union leaders to understand how to engage with new audiences and stay relevant in this ever-changing environment.

Why NAOs Are Crucial to Credit Union Growth

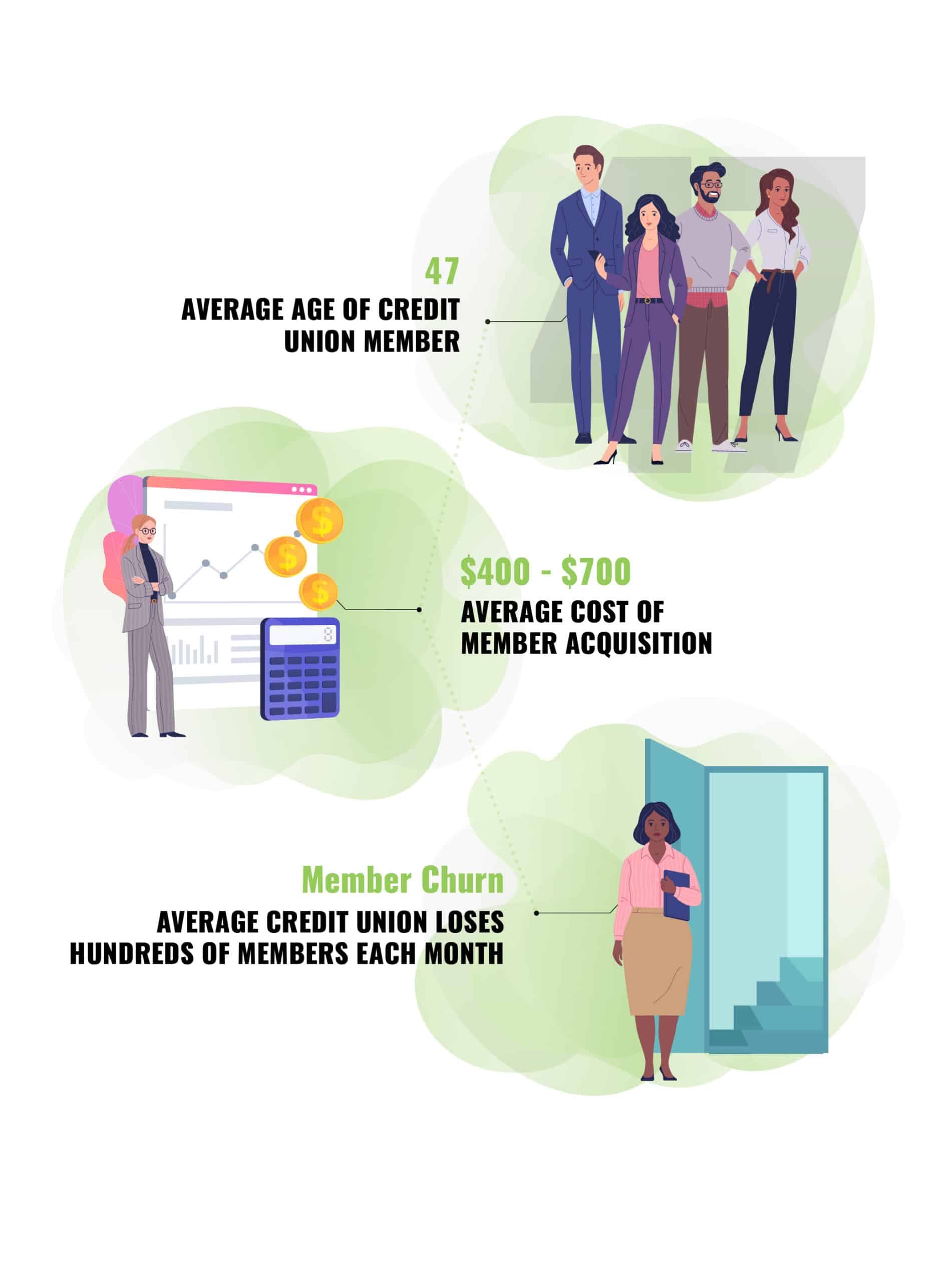

With the rise of FinTech and big banks an ever-present hurdle for smaller credit unions, member acquisition in today’s landscape is equal parts competitive and crucial. During these times, average member acquisition costs can range from $400 to $700, marking a need for NAO-driving strategies that maximize budgets.

Further, the average age of a credit union member is 47, with certain institutions reporting numbers closer to 60+. Because of this, attracting (and retaining) younger credit union members has become a primary focus for numerous institutions looking to replenish members “aging out” of products and services.

Member churn is another factor contributing to the need for a strong acquisition strategy, with credit unions losing hundreds of members each month. Replenishing these accounts is yet another challenge facing credit unions with growth milestones to meet.

Is Digital Marketing the Answer Credit Union Leaders Need?

As a credit union marketing agency, our team has been at the helm of national, regional and hyper-local campaigns leveraging traditional and digital media over our nearly 20 years of experience. In short, we’ve seen it all and have a first-hand understanding of the benefits digital marketing offers credit unions.

Digital Marketing Benefits for Credit Unions

Reach

Digital marketing allows even small, local credit unions to compete with larger institutions with a widespread physical footprint and low cost of entry. Just as online and mobile products and services make it possible to serve members anywhere, anytime, digital platforms bring those products and services to their attention.

For our clients, digital channels such as paid search, display advertising and rich media create expanded territories for service. We can target and convert new members to boost deposits and accounts opened even without physical branches present. For credit unions with lending power across state lines, widening the pool of potential borrowers means more applications, approvals and loans funded.

Targeting

Credit union members (current and potential) have complex layers of needs and wants regarding their finances. Digital marketing allows us to tap into those complexities and address those needs with hyper-detailed targeting and messaging.

With the ability to segment audiences, digital channels allow marketers to get down to the details of targeting. Persona-based targeting begins with creating in-depth profiles of our ideal credit union members, from their age and stage in life, to where they shop, how they manage their money, and their psychographics and attitudes towards finances, credit, savings and investments. Working with a clear and complete picture of who we’re targeting, we can tailor messaging and visuals to align with each persona’s individual needs.

Optimization

The success of credit union marketing campaigns rests just as much on ongoing optimization as it does choosing the right channels and targeting to begin with. Digital platforms allow for real-time monitoring and granular optimization, opening the door for adjustments if you know what to look for and how to interpret the data.

At evok, our credit union marketers remain plugged into developments within our campaigns. By keeping an eye on how budgets are being spent across media, and adjusting those spends based on performance, we can maximize our clients’ budgets while driving credit union-growing results. For example, comparing a markedly high cost-per-click on an auto campaign rich media unit with below-industry-standard costs on paid social may indicate one channel will significantly outperform the other in terms of driving loan applications. In these cases, our team can instantly divert dollars to campaigns where they will have the most significant bottom-line impact.

How Much Should Credit Unions Spend on Digital Marketing?

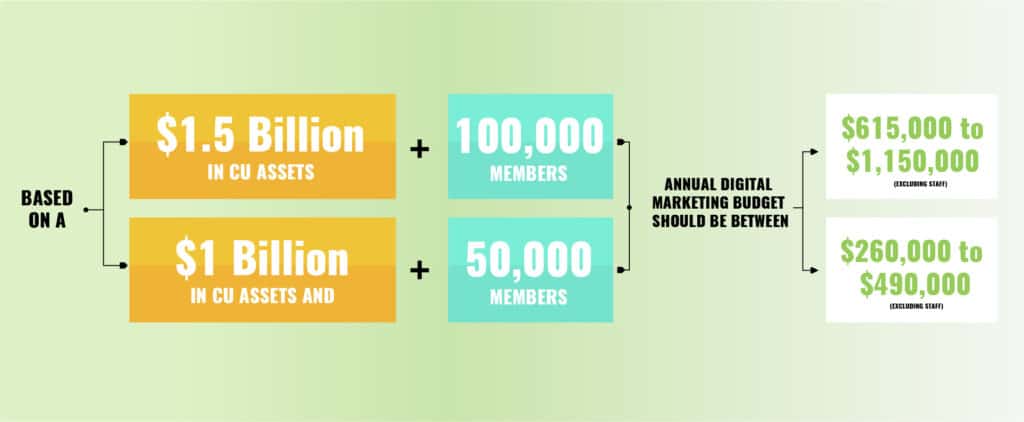

There is no one size fits all answer to the question of how much a credit union should spend on marketing — specifically digital marketing. Digital marketing budgets for credit unions can range from conservative to aggressive. The size of your institution, total assets, membership milestones and staff weigh into creating a bucket to help you meet your growth goals while maximizing revenue.

Digging Deeper into Digital Marketing for Credit Unions

This article just scratches the surface when it comes to NAO-driving digital marketing strategies. Digital marketing’s strengths lie in its versatility, which is why tailoring a strategy for your individual institution’s needs is not only crucial but can lead to results you’ve not quite seen before.

Ready to dig deeper? Give us a call. Book some time with our team to go over our credit union digital marketing services and insights into the current state of the financial industry and trends impacting marketing strategies.