3 Ways to Promote Financial Literacy Month to Increase New Member Acquisition

Filing taxes, buying your first home, saving for retirement, and building investments–these are things many Americans don’t grow up learning and are often left to learn as they go. That’s where credit unions can step in to help guide the younger generations of their communities.

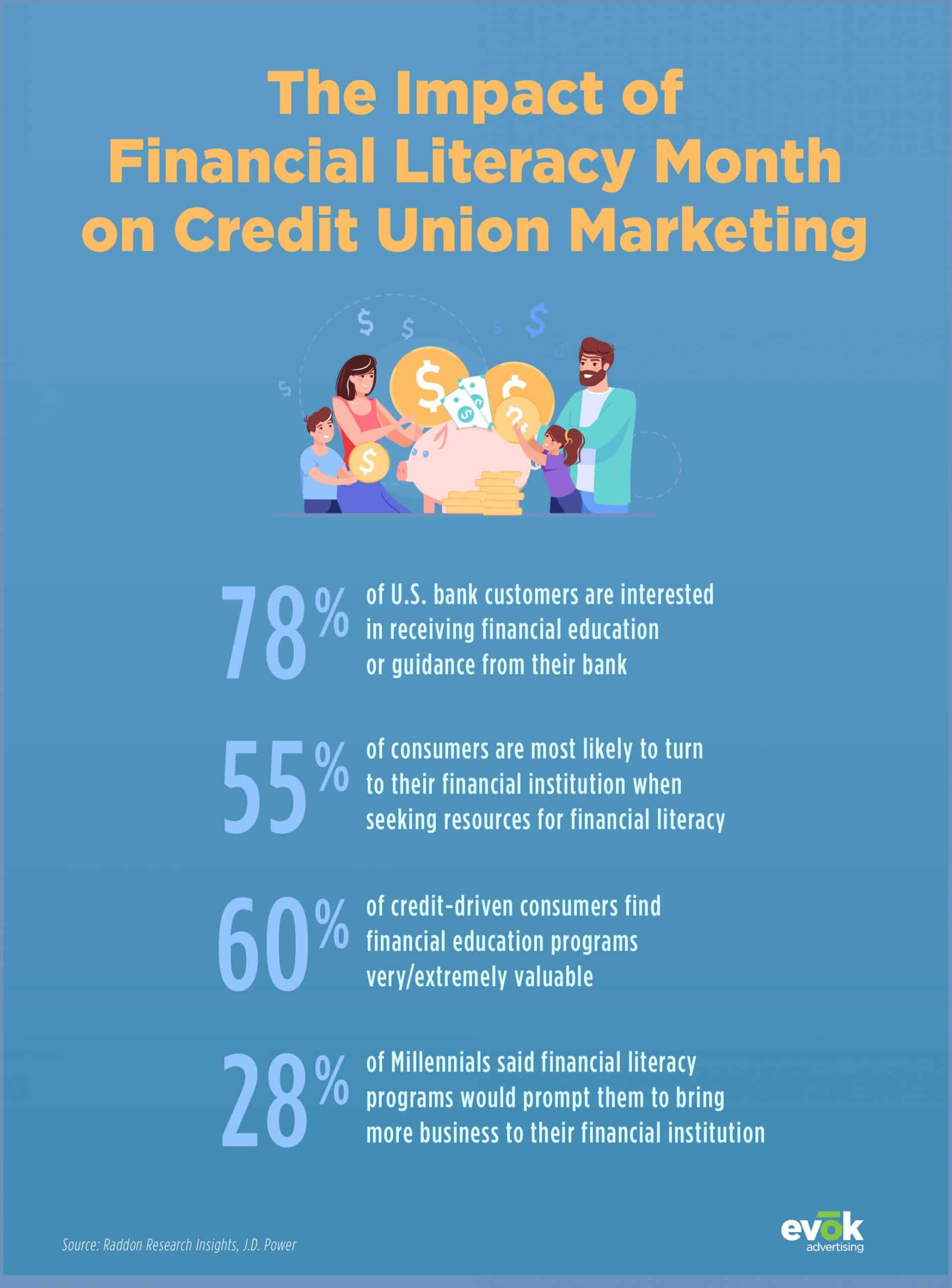

April is National Financial Literacy Month, and credit union marketers are getting on board to help educate members, non-members, and even adolescents to take control of their finances in more ways than one. Financial literacy rewards members but it rewards credit unions too. Raddon Research found that people who understand the basics of personal finances are more engaged and more profitable for credit unions that provide them with financial education.

Here are a few ways you can leverage Financial Literacy Month to help your community manage finances while raising brand awareness and increasing member-credit union connections, too.

Reach a Younger Audience on TikTok

Out with the old and in with the new. Younger audiences like Gen Z are ditching Facebook and heavily using platforms like TikTok to connect with friends, find entertainment and keep up with the latest social and cultural trends. With over 100 million U.S. users, TikTok has been catching the eyes of credit union marketers during financial literacy month, especially as over half of these users are between the ages of 16 to 24. While the popular app is known for dance challenges, duet videos, and viral comedic content, it’s also become an outlet for credit unions to share financial advice.

Raise awareness for the month to teens that are embarking on their financial journey by sharing a series of clips on TikTok covering everything from saving hacks to side hustles that can bring in extra income. This social channel invites credit unions to deliver bite-size information in just 60 seconds, allowing marketers to share enough while teasing the audience to learn more. This approach drives engagement, views, and brand awareness, allowing you to spread the word for Financial Literacy Month while positioning your credit union as a leader in guiding younger generations toward financial success.

Offer a Kids’ Club

There are three fundamental financial lessons to learn as an adolescent–spending, saving, and sharing. More parents are pushing early financial responsibility for their children, and beyond just sharing tips, they’re finding that providing a firsthand experience is more effective. Credit unions can help parents promote healthy habits by offering checking and spending accounts for kids. This year-round service is a great way to improve financial literacy beyond just the month of April while also offering fun incentives.

Here are some ways to promote a youth savings account at your credit union:

- Offer no monthly fees or minimum balances for account holders under the age of 18.

- Host an annual event or party for club members with food, drinks, and games.

- Send out a monthly newsletter with money tips and tricks.

- Gift a “swag bag” upon enrollment with free goodies and promotional items.

Plus, studies show that many Millennials have stuck to their financial institutions for over a decade, which means a kid’s club can allow credit unions to establish trust with members at a young age, ultimately leading to stronger member retention.

Promote Financial Literacy Content

Raddon Research Insights found that nearly half of respondents classified themselves as “extremely” financially literate, when, in actuality, only 6% scored an “A” on the test. But that’s not to say that members aren’t open to improving their financial literacy skills, as almost 40% said that if their credit union offered a financial education program, they would find it very or extremely valuable.

Credit unions have the opportunity to present impactful content to young members that will lead to success both for your brand and for your members’ financial future. But what is your audience looking to learn and how do you engage them? Marketers can leverage Financial Literacy Month to create content in the form of social posts, blogs, infographics, quizzes, and contest giveaways to not only share money tips but also reward members with prizes. As for the content itself, it should focus on the three most popular topics amongst members of all ages: financial planning, retirement, and wealth management. The strong and consistent educational content on your credit union’s social channels and website can lead to higher engagement rates, increased click-through rates, and more leads.

Your marketing team should be armed with the right tools to undertake Financial Literacy Month. A strong strategy across multiple touchpoints can help target different audience segments, build brand awareness and improve current member relationships. So, use this month as an opportunity to educate your members, but remember to keep it fun—an engaged audience is an entertained audience. How will you challenge your credit union brand to try something new this Financial Literacy Month?