How Credit Unions Can Use Big Data to Segment Marketing

With so many diverse options within their fingertips, consumers expect the financial institution they’ve selected to truly know them and their needs. In order to meet their member’s demands, credit unions should rely on data to achieve their goals. When credit unions leverage the data available to them, they are able to better understand members, target them more effectively, reach them through the proper channels, and improve overall business function. Do you have a significant volume of data but aren’t sure how to take full advantage of the information? Are you trying to understand what is big data and why your credit union needs it? Here are a few ways that having the right data can help elevate your financial marketing strategy.

But First, What is Big Data?

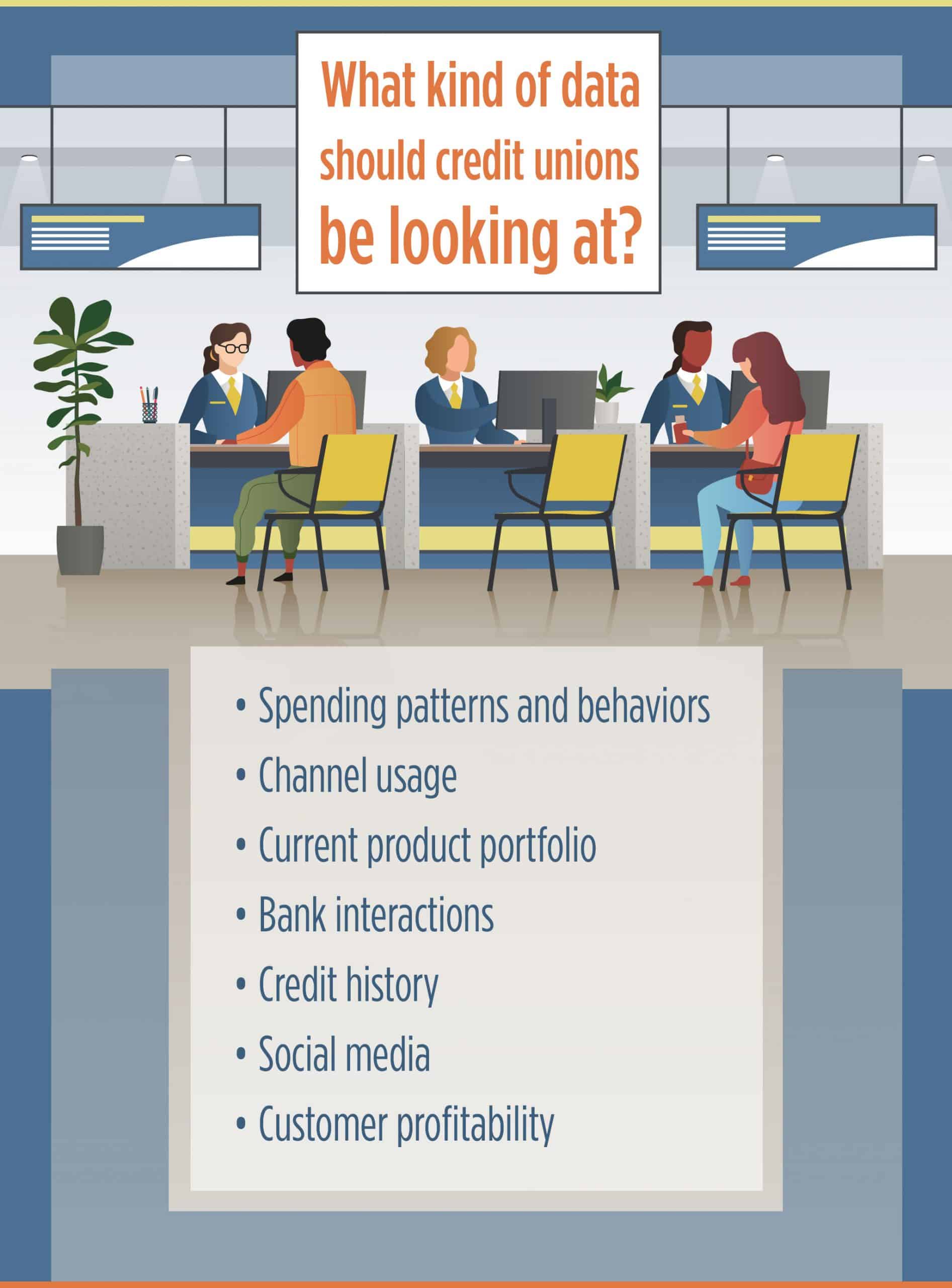

Big data has become the buzzword in marketing strategies across various industries. Everyone knows we need it, but what is it exactly? Big data refers to the collection and use of massive amounts of information gathered from a variety of data sources that can be analyzed and used to determine certain patterns, trends, and associations. These are particularly relevant to human behavior and interactions. Credit unions can access a wide variety of information surrounding their members and integrate this data to improve their marketing strategies and increase overall profitability.

- Spending patterns and behaviors

- Channel usage

- Current product portfolio

- Bank interactions

- Credit history

- Social media

- Customer profitability

Using Big Data to Market Better to Members

The right data can help you stay informed on what offers to make to your members and at the most convenient times, essentially boosting your current marketing strategy. Here are some ways big data can help segment your members and market to them more effectively.

Identify Key Target Members

One of the most important ways that data can help credit unions is in providing information about members. While financial institutions previously relied on smaller, more general bits of data that depended solely on member demographics, big data bridges the vacuum in wealth analysis, channel preference, and purchasing behaviors. These newer segmentation tools measure customer assets and aggregate them to provide highly predictive insights into likely wealth profiles, habits, and needs of current and potential credit union members.

If your credit union wants to increase the number of car loans it finances, data can help identify members most likely to need this type of service. Instead of focusing on a vague target, such as non-Hispanic white males ages 18 to 49, you can market specifically to key target members. For example, you can segment a 20-something recent male college graduate who may be in need of a car to get to their new job. With this laser-pointed data, you are able to pinpoint the key target member or prospective member that may be more likely to invest in this type of loan. This makes the investment in marketing to these individuals more fruitful and beneficial.

Personalize Services to Members

With an increase in Amazon product recommendations based on previous purchases and Spotify playlists curated to their musical preferences, consumers are expecting more and more personalized experiences. Credit unions need to step up to this ever-growing trend in order to meet their member’s expectations. Big data can help credit unions personalize services to specific target segments.

For example, a study showed that using segmentation analysis, credit unions are able to determine the next best product a member would acquire with 30% accuracy. Big data takes the guesswork out of marketing products and services and helps financial marketers’ hone their onboarding and cross-selling strategies with precision.

Maybe you can suggest specific products and services through your mobile app with a recommendation based on their purchase or investment history. Or by analyzing where your members shop via their purchase history, you can incentivize them to use their credit union cards by offering gift cards or rewards points for shopping at places they already frequent. These types of campaigns are win-wins to credit unions and their members.

Improve Credit Union Digital Marketing Strategies

With big data, credit unions can place the right message at the right time in front of the right person. Segmentation helps credit union marketers plan media buys and deliver campaigns across all channels, including digital and social. Don’t just spam your followers with promotions that won’t appeal to them. For example, according to Experian’s Fourth Annual State of Credit Study found that the average Millennial has an estimated average debt of $23,332 and the least number of bank cards, so offers of 0% APR for 12 months by opening a credit card account may not be as attractive as a new savings account offer that matches an increased interest rate through a three-year maturity.

If you are planning on running a marketing campaign to target mortgage buyers using digital media, cold calling, or other methods of data collection can help the credit union learn which methods created the best ROI. You’ll learn what your credit union members responded to and engaged with in the past and use that information to prepare your next campaign.

Data gives you a roadmap to strengthen your marketing strategy with segmentation. It helps credit unions reach the right people in the right way and ensures every dollar you spend on marketing is used properly and effectively. The smarter the financial industry becomes about data and how to deploy personalized communications through segmentation, the greater the level of customer retention and loyalty will be.