How Credit Unions Can Track Offline Media

As digital technology has evolved, marketers have come to expect detailed reporting on their online media spend, including, at the very least, impressions, clicks and view based metrics. Ideally engagement, leads and, ultimately, sales/revenue attribution is tracked also. We can also gauge performance by ad unit size, creative execution, offer messaging and geo-targeting—the list goes on. As the agency, our job is to distil the vast amount of raw data we receive from publishers and ad servers to create a report that clearly shows the key performance metrics in a digestible format that can be understood and used to glean insights and drive future strategy and tactics. And that’s as it should be.

Credit Union Marketers Go Beyond Digital

But what about offline media reporting? Fodder for media departments once was that even though a client might be spending 85 percent of their advertising budget on paid media, all they were ever interested in was the creative. That’s understandable because the creative guys always had more interesting beards and music recommendations. But why so little focus on whether this great message was hitting the right people at the right time? In many ways, offline media has hardly changed since the Mad Men days. Sure, the measuring systems have evolved to try and be more accurate, but at the end of the day we’re still negotiating on ratings, readership and impressions. As long as these are delivered “as planned”, that tends to be that. I’ve been in meetings where a client has dissected and questioned every detail of a digital report with hardly a comment on the much larger TV plan running. However, it’s vital to track and analyze all the channels in your campaign, and the collective goals they are driving towards. For more a more thorough explanation on why it’s important to create and manage your communications plan through an integrated strategy, be sure to read evok’s whitepaper on the subject.

Data, Data and more Data

As marketers have become accustomed to detailed reporting from digital media, it’s inevitable that questions will increasingly arise with regards to the performance of all media. Over the years we’ve used dedicated telephone numbers, offers, coupon codes, business reply cards, QR codes, landing pages etc. to track responses. Direct response TV can also match ads to phone calls and credit union marketers can commission tracking studies, such as pre and post-campaign awareness.

As credit union marketers, you should certainly be comfortable in this world of data, after all it’s a business driven by numbers, as well as, hopefully, great products and service. However, these types of tracking can be incredibly complicated and time consuming to implement and properly maintain, not to mention expensive. As it turns out, you might just be sitting on a wealth of your own data that could help unlock the historical success of your media efforts, and you just haven’t thought to use it.

No doubt you have specific metrics that you track, including awareness, call volume, website visitation, loan applications, accounts opened, revenue etc. You probably have data organized by week, going back some time. If you have a properly managed media plan, you should also be able to easily work out your media activity for the matching weeks. Being able to attribute a cause and effect between the two is the key to unlocking the effectiveness of your advertising.

Before I go any further, it’s important to remember that there are many, many factors that will affect the success of your business—pricing, regulation, competitive activity, the property market, new car sales and any number of other economic factors, both local and national. Even the weather can significantly impact business in different markets. We can only manipulate the variables within our control, those that can influence independently of the external factors. However, if we can successfully identify any kind of correlation between our marketing efforts and results, then we can use this data as a hugely valuable guide for future strategies and tactics.

I’ll be the first to admit it’s a daunting task to try to tackle. Even if you’re just looking at one medium, such as weekly print spend, against one key performance metric, such as weekly call volume, and you’re just analyzing the last year of activity, you’ve already got over 100 data points to work with. A simple way to start could be to just graph the two variables, then try to spot overlap in the patterns. For example, your data might show an increase in media spend resulting in a corresponding increase in call volume. Add in the fact that there’s so much white noise created by all the other influences on call volume (positive and negative) and it starts to become very difficult to make any kind of extrapolation, not beyond the subjective, and certainly not with any degree of statistical certainty. Now, try this while looking at other media and other performance metrics, such as website visitation from your Google Analytics, or—the Holy Grail—revenue, for a true return on investment calculation. Before you know it you’re drowning in data, dozens of charts and no insights. Try taking that to the executive board.

The Regression Analysis Challenge

Regression analysis is mathematical technique that is used to identify statistically valid correlations between input variables, such as media spend, GRPs, impressions etc., and output or dependent variables, such as calls, website visits, leads, sales etc. Before you glaze over, you don’t need a degree in mathematics or statistics to run regression analyses (although I do have one), because Excel can do it for you, given the right amount of good quality data points, and some basic understanding of what you are trying to achieve. And it’s not subjective; it’s proven to a degree of statistical reliability. Keep in mind that it’s not the magic bullet that solves all of our marketing questions, and even a good model will only partially explain what’s affecting your business, but if you could improve your efficiencies by 20 percent, wouldn’t you want that insight?

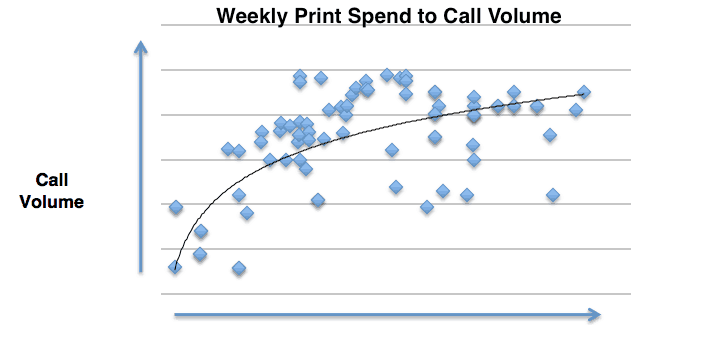

Let me give you a recent, real life example. A credit union was spending several million advertising dollars a year on media. Over a couple of years they ran, in various mixes and weights, TV, radio, newspaper, outdoor and online channels. They tracked call volume, website visits, auto loan applications and mortgage applications. It was an enormous amount of data with no obvious patterns discernible from basic charting. The graph below shows the data points for weekly print media spend and the corresponding call volume going back about 18 months, plotted on a scatter graph, which is a precursor to running the regression.

It’s still difficult to see an obvious pattern here, and certainly not one with a degree of certainty.

After running a regression analysis and plotting a trend line, you can clearly see that there is a positive correlation between increased print spend, but that it starts to tail off fairly quickly—a classic case of diminishing returns.

In fact we ran many, many models for this campaign, each with its own levels of correlation and return on investment. Of course, sometimes you just can’t find a pattern that is statistically significant—perhaps because you don’t have enough data points, or maybe there are just too many other influencing factors—but the beauty of using a regression model is that once you’ve got all the data in a spreadsheet, you can simply run the analysis and quickly see if it’s usable. Excel even provides clear statistical indicators that tell you to what degree the model is valid or not.

Now, we realize that there can be a disconnect between media activity and attributable sales revenue. Closing a mortgage will be weeks or months after a customer has been motivated to contact you after seeing an advertisement or commercial. Even an auto loan is not likely to be approved in the same week. This is why, when we’re using weekly data, we would normally only look at correlations down to calls or site visits, and perhaps loan applications. But as mentioned previously, you can work with your sales team to calculate revenue/margin based on leads and back in your ROI that way.

At the very least this type of analysis can be used to optimize your media mix, weights and overall budget, and, as you delve deeper into it, detailed returns on investment, including exactly how to get to an optimal ROI. And the great thing about it is that it’s probably all data you already have, and have simply have not been using. If you’ve ever been challenged in a meeting with the question, “Why are we spending this amount on our media and what is it getting us?” and you’re hard pressed to give a clear response that’s backed with real facts, then regression analysis might be a great solution for you.