4 Ways to Gain Share of Voice for Credit Unions

Brand visibility is the foundation for many credit union KPIs. Without it, marketers wouldn’t be able to reach current and prospective members to increase the use of their products and services. But which indicators are used to measure performance? There are a multitude of ways to measure brand awareness, such as website traffic, surveys, impressions, and more. But one of the most underrated metrics to help you gauge how visible your credit union is across multiple channels while helping you evaluate your marketing efforts over a specific time or region is called share of voice. Here’s what you need to know about this metric and what credit unions are doing to improve their share of voice in the industry this year.

What is Share of Voice (SOV) and Why Is It Important?

Simply put, Share of Voice (SOV) is the percentage of online content and conversations about your credit union compared to those of your competitors. So, if you were to add up all of your credit union’s brand mentions online and placed them in a pie chart with your competitors’, how big would your slice be? The answer to that would be your share of voice.

How Can Credit Unions Calculate SOV? Take the total industry mentions / divide your credit union mentions *100 = your SOV

In digital marketing, your credit union’s share of voice is a metric measured as a form of brand awareness to find out how many news sites, blogs, social media, forums, and even offline channels are talking about your brand in comparison to direct competitors. This competitive analysis can be broken down even further by topic, language or region to uncover deeper insights.

The importance of measuring share of voice is to better understand what members are talking about, what they demand, and areas of improvement. Ultimately, the bottom-line goal of this metric is to increase talk about your brand, and in turn, increase revenue. By growing your digital footprint and SOV, you can also grow share of wallet.

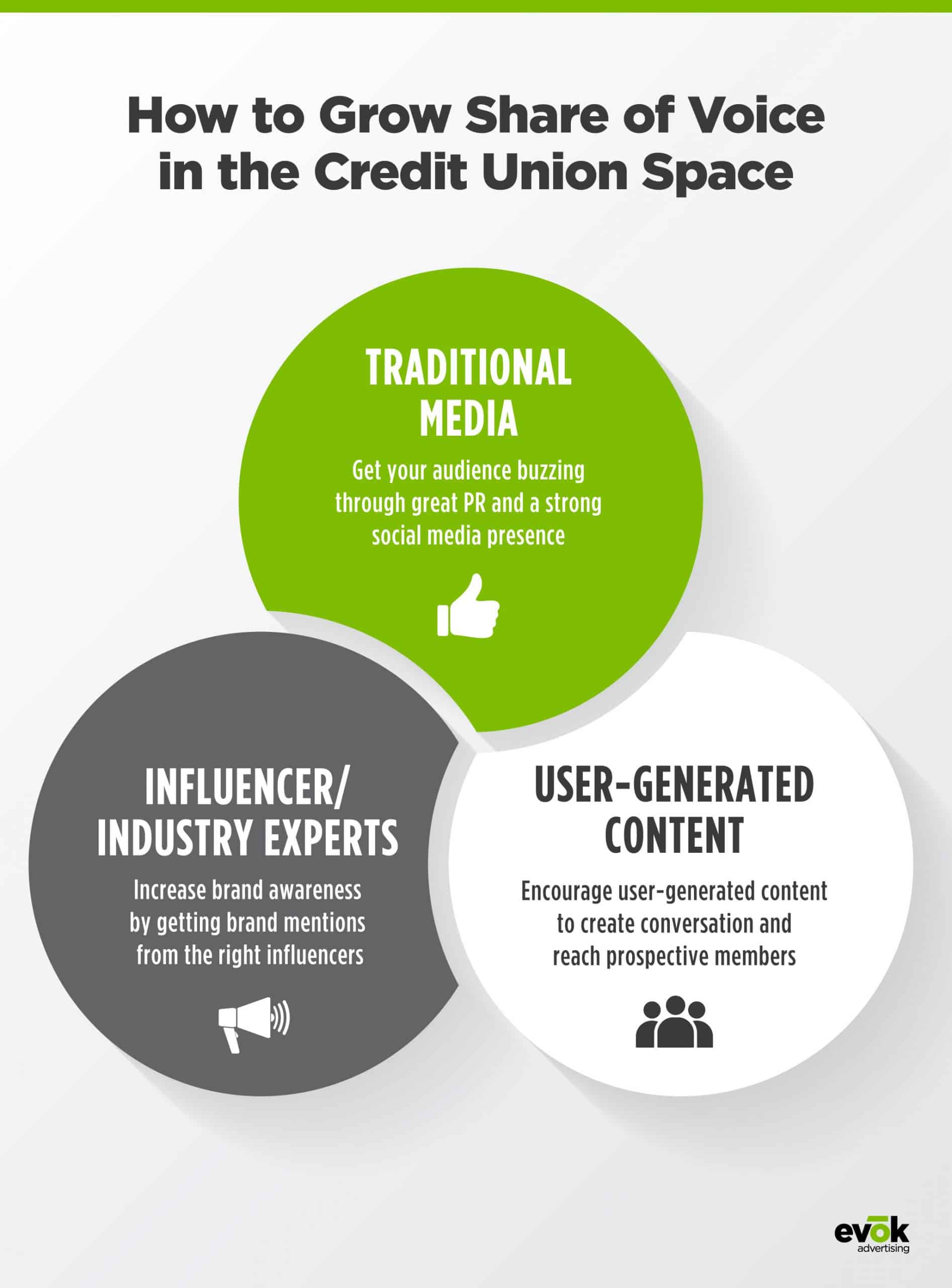

Ways to Increase Your Credit Union’s Share of Voice

Increase Google Ad Spend

One of the best ways to build share of voice and positive associations with your credit union is through Google Ads. With the right strategy and spend, you can reach prospective members at the right time and place through thousands of websites nationwide. Going further, placement targeting in Google Ads allows you to help reach a relevant audience for your credit union through rich media and CPM bidding.

Build Your Social Media Presence

One of the biggest, and easiest, channels to increase SOV is through social media. A robust social media presence is the first step toward building trust amongst members, but going the extra mile to provide quality and shareworthy content can leverage your credit union above leading competitors by adding value to the mix. So, whether you create a content strategy that includes “Financial Literacy Friday” or share tips and tricks on how to pay down debt, build wealth or adopt smart financial habits, your following is more likely to hit the “share” button and spread a positive word about your financial institution to friends and family, organically increasing your SOV.

Try Influencer Marketing

Another tactic to increase brand mentions through social media is by taking on an industry thought leader or social influencer to lead conversations amongst their followers. With big exposure and dedicated followers, there’s a big opportunity for SOV that many credit unions are forgetting, especially to reach younger generations like Gen Z and Millennials. This measurable tactic also allows you to track likes, shares and comments to view overall performance and experiment with various influencers to find the right fit for your brand.

Improve the Health of Your Website

A high ranking on Google doesn’t just make it easier for prospective members to find you, it also helps them confirm credibility. People are no longer digging through search results to find a credible financial institution, they habitually put their trust in top-rated results to meet their demands. That’s why it’s important to take a look at the general health of your website and fix errors, warnings and notices in order to help members find the financial services they’re looking for with ease. This goes hand-in-hand with developing a website design that’s ADA compliant and offers a seamless experience across every device.

By increasing your share of voice, you’re doing more than just building your brand awareness. Share of voice engages your members by initiating conversation and spreading the word about your credit union. It may just be an illustration of where you stand against competitors, but it can help you finetune your marketing strategy to successfully communicate with your members to meet their demands. So next time you craft a campaign or shift your marketing strategy, think about your “slice of pie” and how you can leverage your strengths or improve your weaknesses to make it bigger. By increasing your share of voice, it can ultimately pay off in dividends.