How Pay-Per-Click (PPC) is Changing the Financial Landscape

There’s fierce competition in the financial industry when it comes to climbing the organic rankings on search engines, and with 75% of users never venturing out to the second page of search engine results, it makes it that much more difficult to win the trust of prospective members for many banks and credit unions.

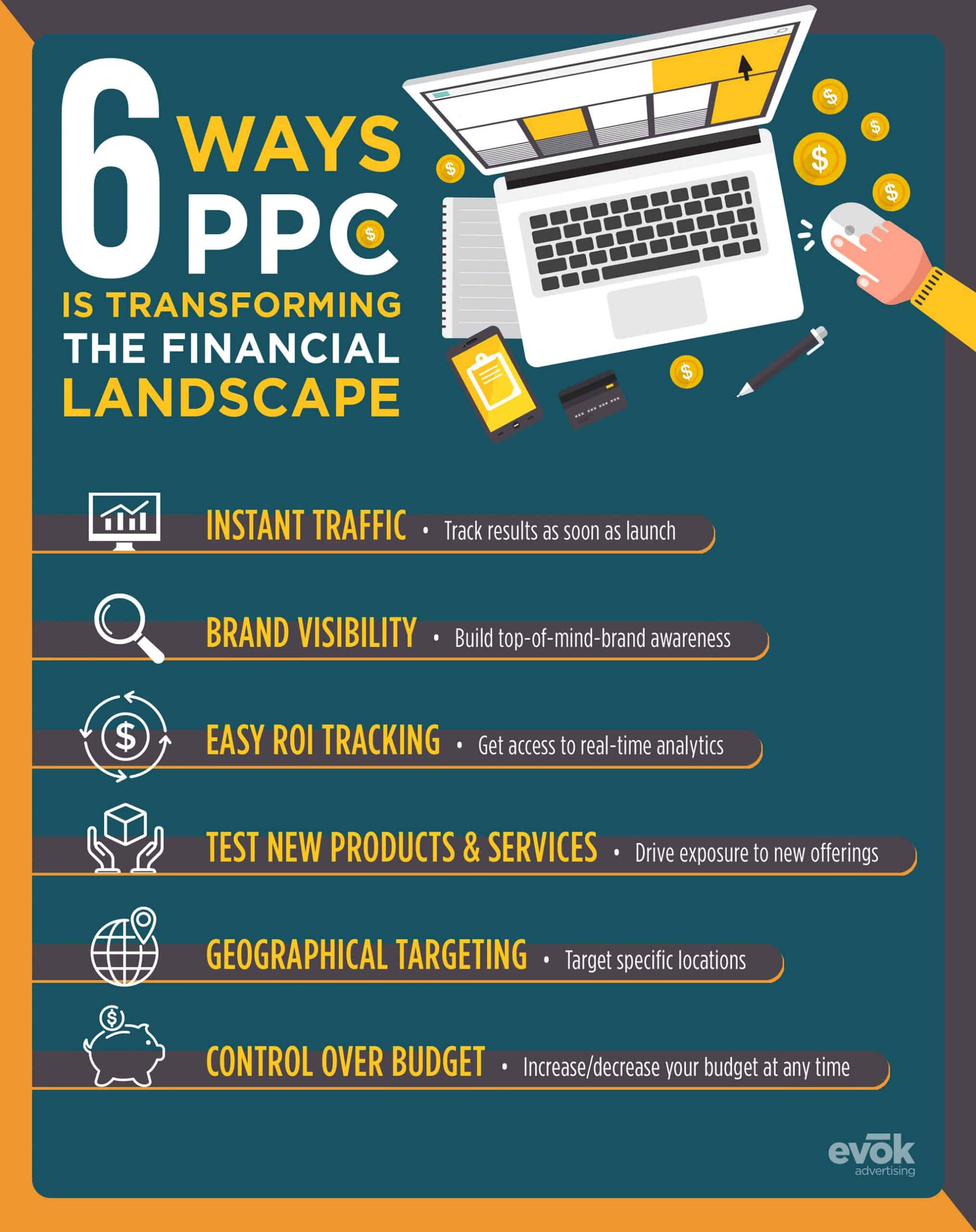

Luckily, pay-per-click ads, otherwise known as PPC, have changed the financial landscape and how financial operators can effectively reach members without fully depending on organic rankings to do the heavy lifting. By diversifying your marketing channels to more than just SEO, you could be opening the door to nearly 41% more clicks if you secure a spot in the top three paid ads on the search results page. But before you dive into new marketing avenues, here’s what you should know about PPC ads and why they are growing in popularity among financial institutions.

Why Every Financial Institution Should Utilize PPC Marketing

Instant Traffic

Just like any other marketing service, search engine marketing requires patience—because even a strong strategy takes a little trial and error to get a return on investment. But unlike most marketing tactics, PPC advertising publishes as soon as it’s approved and, in turn, delivers immediate results. This fast turnaround gives financial operators the opportunity to launch a campaign quickly and tweak it as necessary in order to reach the right market.

Whether it’s for product launches, event-focused marketing or seasonal promotions, PPC ads give financial institutions the ability to reach customers who are actively searching for terms and phrases associated with your campaign. This instant exposure holds a particular advantage during seasonal promotions, considering these ads are only set to run for a limited time. Reach your audience quickly and effectively with PPC ads and start reaching noticeable rankings that can lead clicks to conversions.

Brand Visibility

In the land of banks and credit unions, finding your competitive edge can be a challenge. Brand equity is key to earning the trust of current and prospective members, and with PPC ads placed at the top of search engine result pages, it’s become a widely favored and reliable avenue in helping financial operators build top-of-mind brand awareness.

Today’s digital users are increasingly more cautious when it comes to trusting brands they discover online, but PPC can gradually introduce your financial institutions and its services in hopes of securing new members over time. In fact, a recent Google survey revealed that when nearly 800 consumers were asked to name which brand came to mind first for a keyword in a specific category, an average of 14.8% in the Test group named the test brand, demonstrating an 80% lift in brand awareness due to PPC.

Easy ROI Tracking

As with any marketing effort, your ultimate goal is to monitor performance in hopes of achieving optimal results. Fortunately, PPC marketing allows you to have access to real-time tracking analytics with minimal web code updates, giving financial institutions the upper hand in easy ROI calculations and the ability to fine-tune the execution to generate stronger results.

And, PPC analytics are thorough, providing a strong understanding of what your hard-earned budget is really going toward and what kind of results it is delivering. From the money you put in, to the return you’re getting out of it, PPC has become a favored tool among financial institutions to test a variety of campaigns, strategies or landing pages to find what is most effective for your brand.

Efficient Ways to Test New Products and Services

For those times your new auto loan rate is highly competitive, or you integrate a new feature to your online banking system, PPC advertising makes for a great go-to tool when it comes to driving exposure for your new offerings while allowing you to expand your budget at your own pace.

And with over 40,000 searches per second and 3.5 billion in a single day, the opportunity to reach your audience through PPC is highly probable. In fact, a recent study has found that 65% of users who are searching for a product or service hit pay-per-click ads and view them as a trusted source.

Geographical Targeting

The growth of digital marketing has given brands the opportunity to fine-tune their targeting to a tee. Localizing ads can give you a leg up in the financial marketing space, as you have the power to pinpoint when and where to find your current and prospective members. This key advantage in PPC advertising gives financial leaders control in more than just enticing creative and messaging, it reaches a vaster audience within a limited geographical footprint for optimal results.

This incredibly valuable tool for banks and credit unions is most effective for those that only serve a limited region or state. For example, if your financial institution is only located in Georgia, then serving PPC ads to someone in Texas wouldn’t offer a return on investment. That’s why identifying the most valuable geographic areas is essential to make the most of your PPC campaign.

Complete Control Over Budget

Unlike other marketing tactics, pay-per-click isn’t just a one and done deal when it comes to your budget. With the ball in your court, you can increase or decrease your budget as you see fits since you only pay when a user actually reaches your website. However, having the power to manage your budget doesn’t always mean you should aim low to save money or invest too much in hopes of gaining tremendous exposure. By using a financial marketing agency, you’re offered the guidance it takes to set your budget just right, so you can get the most results of your marketing dollars.

Conclusion

The bottom line comes down to this—it takes a comprehensive search engine marketing presence to wheel in members for any financial institution. Steady inbound traffic through search ads is an effective tactic to not only reach the average digital user, but also an opportunity for them to explore your website, services, and products in a seamless user experience.