How Content Marketing Can Build Trust in Your Financial Institution

Content is the way to customers’ hearts—but you’ve got to stay on top of it. Consumers have come to expect the availability of different forms of interaction with brands, which has led to a need for value-based content. Ad overload has led customers to only give their business to companies that they can trust. They’ve learned to tread lightly. So, if you want to win them over, you’ll have to earn their trust the new-fashioned way—by swapping obvious promotions for unique content. Bringing valuable information to the table will extend a friendly invitation to get acquainted with your business and start a conversation.

Despite the demand for valuable information from businesses, in 2018, the financial services industry ranked as the least trusted of all business industries, and content might be the culprit. Building trust with customers is a constant process, and if you aren’t closely watching what you publish, you can’t make adjustments that will keep the relationship healthy. That doesn’t mean that your content marketing is failing—it just needs to be strategic and serviced every once in a while.

The obvious benefits of content marketing exist in fostering a relationship between customers or members and a provider, but it’s imperative to know how to spice things up and continue to maximize your return. If you want to step up your content marketing, you’ll have to be the change you want to see in the financial industry. Redeeming trust in finance starts with you and with your content.

Wait for the “R” and Manage the “I”

Content marketing isn’t a short-term campaign, but you can still link your strategy to reaching your goals and improving your ROI. Lead generation was cited as the top goal for the content marketing of both B2C and B2B marketers and, per dollar, content marketing does produce roughly three times more leads—but this climb doesn’t happen overnight.

A study by HubSpot found that companies with over 400 published blogs received twice the amount of traffic as those with less than 400. So, whether you’re on blog number five or five hundred, there’s still more to be said.

Cheryl Parker, evok’s director of client services weighs in, “Being married to content marketing is the same as any other relationship. It has to be nurtured, tenured and given a lot of attention in the short and long term.” Here are some actionable steps that you can take to re-vamp your content marketing today and start seeing the “R” in ROI.

Be a Guru

Answer the Questions You Already Have

Only 37 percent of customers feel that banks adequately understand their needs and wants. By providing informational content that customers are already searching for, you can become a resource for knowledge and a provider of service.

Is there a section of your website that consumers or members are confused about? What pages do people drop off on your website and are you meeting their needs? Maybe there’s been a surge in questions on a particular topic across your social media accounts. Do yourself a favor by creating a guide you can point them to and do your customers and members a favor by providing consolidated answers. Listen to the voices in your financial community before looking to reel in outsiders.

Answer the Questions You Don’t Have

The two factors that drive customers’ desire for personalized experiences are control and information overload. They want control of the information being consumed so they aren’t trapped in an overwhelming circuit of useless information. This is why innovative content marketing is the best way to keep your footing as a value provider.

Customers want to be able to choose their own destiny, and they’ll want to see every alternative they might run into along the way–even if they didn’t know it existed. You don’t have to be a fortuneteller to get it right, but truly understanding who your members are and what they expect from their financial institution is a good foundation. If your content is personalized enough to speak directly to your members, it becomes easier to predict their wants and present the answers they need.

There’s always going to be an opportunity to answer a question your customers or members haven’t asked yet. Spend some time researching what those inquiries could be and stay a step ahead of your FAQ.

Answer Questions Differently

It may seem obvious that there are many different ways to take advantage of credit card rewards, but there are ever-changing answers to supplement a common question for members. As a financial institution, you have unique insight on a lot of burning topics, which is always going to be useful for those constantly looking for new ways to be in control of their finances.

Nearly half of 18- to 49-year-old people find their news and information online. This isn’t a media trend, it’s modern absorption. By differentiating your content marketing, you can become the resource that users refer to when they do their financial homework–a trusted source.

Be Personal

More than 40% of US consumers have left a company because of a lack of trust and issues with personalization. But how can you give your content a personal touch without any actual human interaction?

The relationship with your members and customers is the center of your business, and technology has driven most interactions away from your physical locations. Regardless, you expect your employees to be personable, familiar and approachable to clients. So, let those faces lend their voices to the users banking from their phones. For example, you can write a blog with tips from your representatives or post videos that highlight your staff members. Showcase your team being out in the community paying it forward.

Authenticity is an effective way to get eyes on your products and services while creating an impression that sits well with customers, and one of the best ways to be transparent is by hearing from them directly. Eighty one percent of consumers want brands to know how and when to approach them, which is easier to do when you listen to those who’ve already put their trust in your financial institution. Your content should include anecdotes and stories from customers whose business you already have, based on the wants and needs of those you want to earn.

Earning your customers’ trust doesn’t have to happen with relationship banking alone but be tasteful about it. Don’t overload your channels with so many testimonials that it serves the opposite of the intended effect.

Give Your Content a Makeover

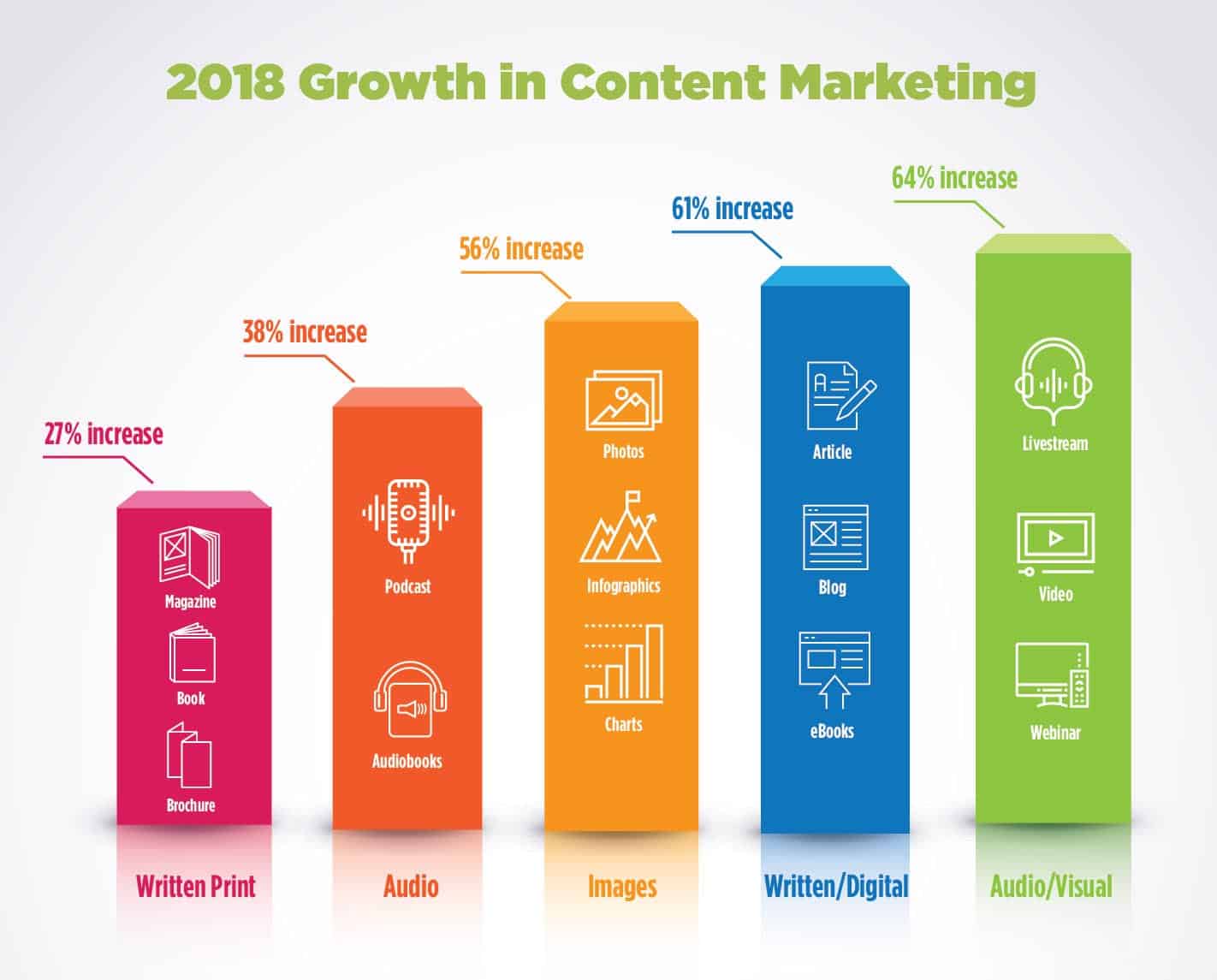

Brands are producing more content than ever. Video series, podcasts and ebooks are now a regular part of what a company publishes. In the past year alone, there has been a huge increase in audio/visual and written content. So, if you’re publishing more, you’ll need to modify it from the increasing information that customers will be faced with.

Wondering where to start when diversifying your published output? Look to your audience for help. The content you make will have to be relevant to the people you want to see it and compelling enough to make them search for it. Infographics and other visual assets in particular are strong tools to make data more digestible for readers and unique to your brand. Stick to your guns and make content true to your institution’s voice and true to your members’ needs.

Make Waves in the Omni-Channel

Customers and members can view their balance online, deposit a check with their phone and stay up to date by following your social media, so it’s important to make sure all of your channels are providing a seamless flow of content.

It should be easy for customers to jump from social media to your website and everything in between because it’s what they’ve come to expect. More than two thirds of the customers of financial services will be digital-only users in the next few years, which puts convenience, accessibility and innovation at the forefront of your digital channels—and your content isn’t exempt from these standards.

Having a strong presence across the board is going to help target customers in the most effective way. Digital channels are the most popular way for customers to open credit, savings and checking accounts, creating a prime platform to add utility-driven content laced with relevant product placement. Provide users with valuable information and guide them to the right products in the right place.

The people have spoken, and they want more content. While content marketing won’t make your financial institution an overnight success, it will drive customers to trust your judgment and rely on your opinion, which fosters lifelong relationships. Be adaptable and responsive, and don’t forget to craft your content the same way.