Bridging the Generational Gap in Credit Union Marketing

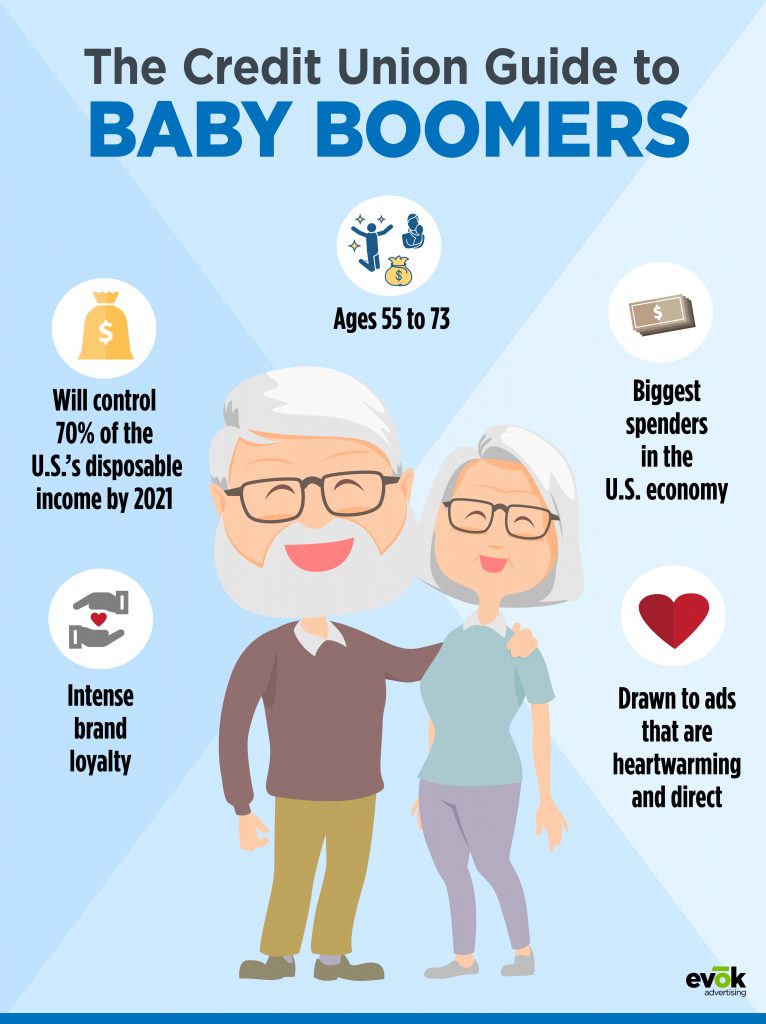

Baby Boomers are still booming. They make up a substantial portion of the world’s population and are an economically influential generation. This generation has unique needs and priorities when it comes to managing their wealth. They desire rich and dynamic experiences as a reward for their years of hard work, such as traveling the world or investing in a new business venture. Because of this, credit unions are in the perfect position to be Boomers’ financial partners, helping them fulfill their desires. And that’s also why it is so important for credit unions to build a bridge, through their marketing strategies, to reach Boomers at their level.

Sometimes it seems like Baby Boomers are on one side of a cliff and credit unions are on another. Boomers may not see the value of going across and reaching the other side, which is why it is up to credit unions to build a bridge and help them cross the gap with security and certainty. A credit union marketing strategy focused on addressing this generation’s financial needs can be that bridge.

Survey Current Members

Having worked with credit unions updating their marketing strategies, we’ve learned that brainstorming sessions with executives can only get you so far. Hearing from real members is invaluable.

A popular way to gather large amounts of member feedback is through focus groups, which offer the advantage of having direct interaction with your members. While online surveys seem more practical and efficient, focus groups allow you to engage with your members and gain real insights. By having a direct conversation with your members, you are able to ask further questions based on their responses compared to asking them to tick boxes on an online survey.

It’s important to note that creating a comfortable environment is key to a successful focus group. Having a knowledgeable and friendly moderator asking specific, open-ended questions and having a clear goal in mind can help create a more welcoming and relaxed atmosphere. Once you know what your Baby Boomer members expect from you, you can build a strategy that will create a better experience for them and that will attract new Boomer members.

Design Seamless Online and Mobile Experiences

There is a common misconception that Baby Boomers are not as tech-savvy as Millennials or Gen Z, but the reality is that Boomers are becoming big users of technology. In fact, 52% of Boomers regularly use a mobile banking app. While Baby Boomers are loyal to their brick-and-mortar branches, they value convenience. The ease of simply depositing a check into their account through a mobile app is too good to pass up.

It’s important to design online and mobile interfaces that are user-friendly and make the experience seamless, not frustrating for this generation. Mobile users take functionality, consistency, and connectivity seriously. A seamless design can create a better overall user experience for members.

Ensure that your app has large buttons and text, since ¾ of people above the age of 50 need to wear prescription glasses. A great example of a Boomer-friendly interface is the KoalaPhone app on Google Play. While the phone retains all the classic smart features, the buttons and notifications are enlarged. Buttons have vibration feedback and texts can be read out loud. The simplified interface helps make the online experience more pleasurable for Baby Boomers.

Other important things to pay attention to when designing an online banking app with Baby Boomers in mind:

- Slowly introduce features over a gradual period of time to prevent an informational overload.

- Provide subtitles on video or audio content.

- Choose colors high in contrast.

Leverage Social Media

Not only are Boomers actively using mobile apps, but they are also increasingly using social media networks. 82% of people over the age of 50 have at least one social media account, with Facebook being one of the leading platforms. This may come as a shock but there are more Facebook users aged 65 and above than those in the 13 to 17-year-old age group. With so many Baby Boomers on Facebook, it’s important to leverage social media within credit union marketing.

So, what’s the best way to attract Boomers to your Facebook Ad? First, tug at their heartstrings. This generation values family, love and togetherness, so they find ads with these heartwarming messages relatable and likeable. Second, make sure your message is direct and clear. While Boomers are attracted to ads based on emotions and experiences, they respond to ads that describe the quality or value of a brand or service. A great way to generate strong positive brand perceptions is creating videos that are slower-paced, longer, and packed with information. If you keep your message to the point and include a touching story, you will be more likely to attract Baby Boomers to your Facebook ad.

Create Targeted Loyalty Programs

Baby Boomers have an unwavering sense of brand loyalty—58% of Boomers have never switched financial institutions. Creating a loyalty program gives you an opportunity to increase purchases while reinforcing loyalty. A recent research found that Boomers join loyalty programs to save money, to receive rewards and members-only benefits, to learn about new products, and to be treated like a VIP. Additionally, Boomers seek rewards for their years of hard work in unique experiences, so try incorporating travel-related spending and incentives to draw Boomer members to joining your loyalty program. Keep in mind that your program should be simple and easy to navigate and must continuously demonstrate value in order to maintain Boomers’ engagement.

Baby Boomers are looking to increase revenues and profits, making this generation a great target market for credit unions. There are many strategies to bridge the gap between Boomers and credit unions through marketing but identifying which strategies will work best for your institution and how to implement them successfully can be difficult. Sometimes it’s best to hire an advertising agency experienced in credit union marketing to develop and deploy campaigns helping you save time and money in the long-run.