Smart Watches and Your Credit Union

Banking with Wearable Technology

The introduction of wearable technology is rapidly changing the way society operates. The impact of wearable devices, however, goes beyond just social behavior – it’s intended to change and improve everyday lives, healthcare and personal finances. A new and significant game changer in the wearable devices market is the Apple Watch, released to the public in April 2015. Smart watches are anticipated to lead the market in wearable technology with Generator Research, a digital technology research firm, projecting 214 million units to be sold by 2018.

For financial institutions, wearable technology is an opportunity to provide your customers with immediate access to financial data, inquiries and personal account information in a whole new way. Consumers want immediate access to their data and expect their service providers, including their credit union, to provide it as soon as they need it, regardless of where they are or what they’re doing.

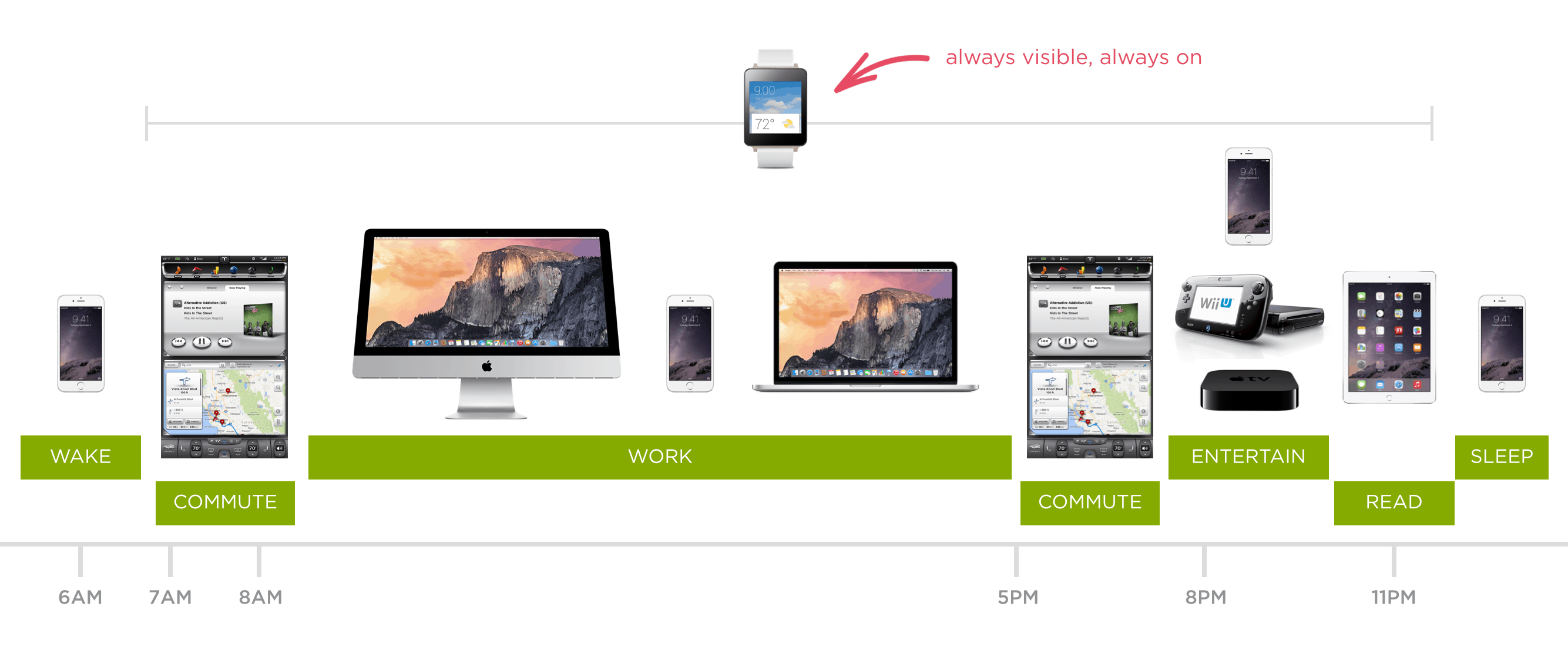

The idea behind smart watches is that everything you could possibly need is just a glance away and it’s literally “hands-free.” Your wallet, phone, GPS, entertainment, finances and more are available at any given moment through your watch – and it still serves the traditional purpose of timekeeping. The graphic below, courtesy of Luke Wroblewski, does a great job of showcasing the multi-functionality of this technology.

In terms of smart watch banking, think voice-activated banking, funds transfers, fraud alerts and banking updates all at the touch of your wrist. U.S. Bank, Wells Fargo, and ING Direct Canada are just a few financial institutions that are looking into developing apps for this kind of wearable technology – and your credit union should begin to think about the subject and how it will affect your audience too.

Weighing the Pros and Cons

At a glance, it seems as though hopping on the smart watch bandwagon would be hugely beneficial for your credit union. However, as with any major technological breakthrough, there are advantages and disadvantages to making this transition. Below are a few major ones to consider:

Pros:

- Your customers will have immediate access to banking features that would otherwise require a face-to-face interaction or log in process through a device. Smart watch technology would be able to offer your members shopping advice in real time, help them manage their personal finances, send alerts and answer financial inquiries in a relatively quick manner.

- Convenience is key. Smart watches will change the way individuals make purchasing decisions. It offers an extremely convenient means of making a purchase or transferring funds, and this level of convenience is highly valued by customers.

- Launching a banking app that’s compatible with this type of wearable technology would set your credit union apart as an industry leader. Yes, it’s a bold and risky move, but it also demonstrates a deep and proactive understanding of your members’ needs.

Cons:

- Although wearable devices are rapidly gaining attention and popularity, they still aren’t considered mainstream. According to Accenture, consumers will warm up to this technology eventually, but at a slower pace.

- Not everyone wears a watch on a daily basis. It’s sole feature of timekeeping has been replaced, for most, by a smart phone. Those that aren’t willing to invest in a watch now will most likely hesitate to invest in a smart watch, even with the bundled features.

- Smart watches are expensive – both for your credit union and your members. Slow adoption of these devices is, in large part, due to the high cost.

Even with smart watch banking in infancy stages, it’s still important for your credit union to understand its potential impact on the industry.

After weighing out some of the pros and cons, do you see the adoption of this technology in your credit union’s future?